Business valuation helps to determine the true worth of a company and is essential when preparing for an M&A deal, selling a business, attracting investors, or raising capital. Thus, this is critical for business owners, potential buyers, and investors to know the basics of business valuation and to understand how to calculate the fair market value correctly.

The article below explores the most common business valuation methods and gives tips on what software to use to complete valuation efficiently and fast.

What is a business valuation?

A business valuation is a process of determining the economic value of a company. It usually involves assessing various aspects and elements of the business, like its financial performance, liabilities, market share, growth potential, liquid assets, and property.

A company valuation is typically conducted by qualified industry experts who have knowledge and training in evaluating the worth of a business. For example, a certified accountant, a business appraiser, or a financial analyst.

To assess the fair market value of a business, quantitative and qualitative factors are used.

The quantitative factors include financial analysis which involves reviewing the company’s financial documents such as income and balance sheet statements. They help to determine a business’s profitability and financial performance.

However, financial analysis alone isn’t enough for a company’s accurate valuation and that’s why qualitative factors, such as the company’s industry position, management expertise, current market trends, and intellectual property should be considered.

The most common reasons for a company’s valuation are:

- M&A deal preparation. The M&A buy-side process involves determining the target company’s present value to negotiate a fair price. Additionally, a business’s valuation can help identify potential risks, which allows the buyer to make an informed decision, adjust a purchase price, or demand additional warranties.

- Fundraising. Potential investors, especially those acquiring a substantial interest in the company, need a valuation to determine a fair price for the investment opportunity.

- Exit strategy planning. Business owners, when deciding to sell a company, need to know their business’s worth when putting it on the market. A valuation can also help identify areas for improvement, which can increase the company’s value.

- Estate planning. It’s critical to accurately estimate the value of a business to have enough funds to pay for any estate tax liabilities in the future.

- Divorce proceedings. When a business owner gets divorced, a valuation may be necessary to divide the marital estate. Often two sides conduct separate valuations to get an accurate picture of the current value of a business.

- Shareholder disputes. Disagreements between owners, buyouts, mergers, or other transactions that result in a dispute require a valuation as part of the settlement process.

- Succession planning. Gifting the business ownership to the family or selling it to third parties requires a business valuation to determine how ownership will be transferred.

- Insurance purposes. Insurance companies normally require a business valuation to determine the replacement cost of the business in case of its loss due to a fire, natural disaster, or other events.

How virtual data rooms help with business valuation

A virtual data room is an online repository used to store, share and collaborate on confidential documents securely during various business processes, like a business valuation.

The VDR providers suggested in the table below are considered the most suitable for business valuation purposes. Let’s compare them in terms of the tools and services they offer.

| Features group | Functionality | Ideals | Firmex | Datasite | Citrix | Box |

| Security | Watermarks | ✅ | ✅ | ✅ | ✅ | ✅ |

| Redaction | ✅ | ✅ | ✅ | ❌ | ❌ | |

| Remote shred | ✅ | ❌ | ❌ | ✅ | ❌ | |

| Fence view | ✅ | ❌ | ❌ | ❌ | ❌ | |

| Granular permissions | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Document management | Bulk upload | ✅ | ✅ | ✅ | ✅ | ✅ |

| Built-in Excel viewer with formulas | ✅ | ❌ | ❌ | ✅ | ❌ | |

| File merging | ✅ | ❌ | ❌ | ❌ | ✅ | |

| Reporting | Audit trails | ✅ | ❌ | ❌ | ✅ | ✅ |

| User activity tracking | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Collaboration | Auto-assign questions to experts | ✅ | ✅ | ✅ | ❌ | ❌ |

| Annotations | ✅ | ✅ | ❌ | ✅ | ✅ |

Now let’s see how exactly these features can contribute to fast and efficient business valuation.

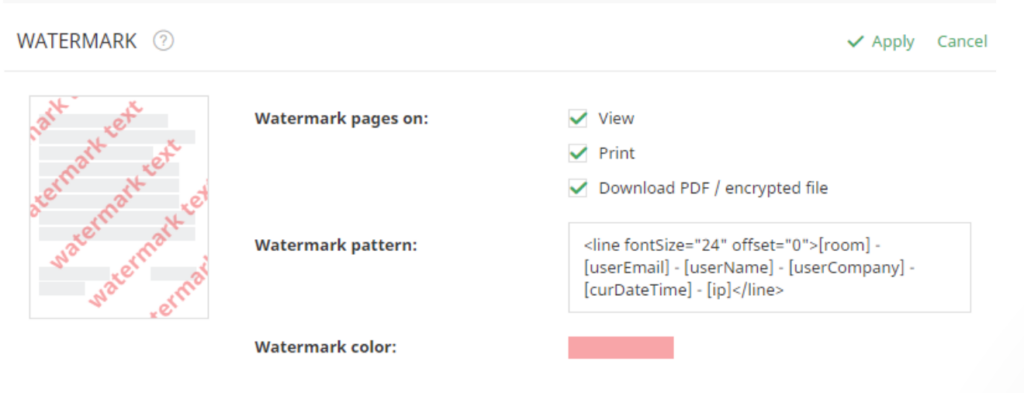

1. Dynamic watermarks maintain confidentiality and prevent unauthorized distribution of sensitive data by letting administrators see who viewed, edited, or printed a file.

2. Built-in redaction helps to hide confidential data like personal information or employee salaries from unauthorized users by blacking it out.

3. Remote shred allows admins to delete documents from a user’s device even after downloading.

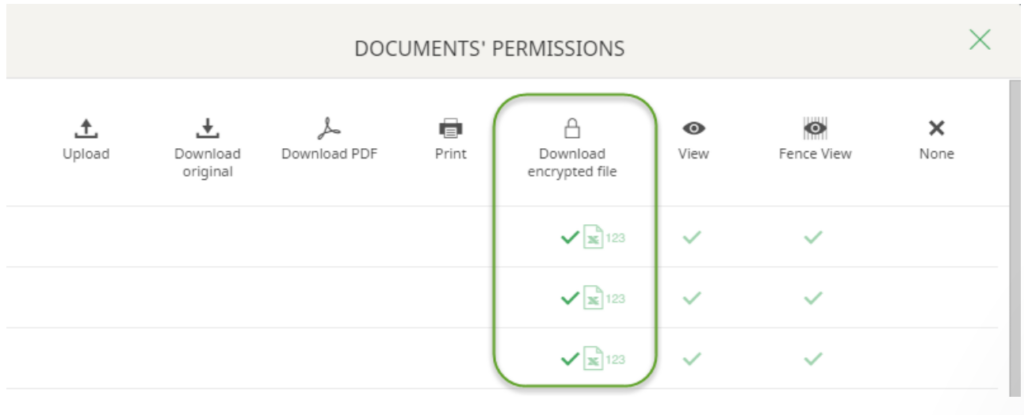

4. Fence view allows a user to only see a part of a document while the rest is covered with a sliding barred screen.

5. Granular document permissions specify a user’s access rights for each document, like viewing, fence viewing, downloading, printing, etc.

6. Bulk upload saves time by letting users add files to the VDR with no limits for size or number.

7. Built-in Excel viewer with formulas lets users work with Excel files right in the VDR. This is a very useful feature during the financial analysis part of a business valuation process as, normally, there’s lots of financial data to process.

8. File merging combines multiple files into one so that business valuation participants could easily navigate and access documents and complete their tasks faster.

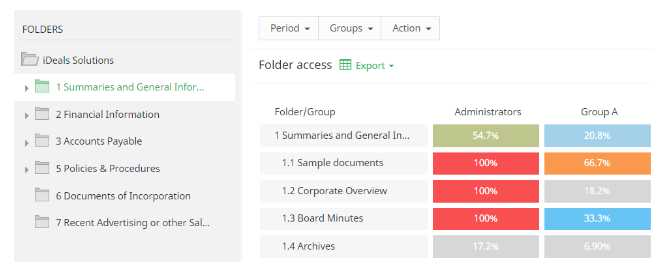

9. Audit trails provide a record of every action taken within a VDR, which is essential for security, legal and regulatory purposes during a business valuation.

10. Annotations add notes or comments to documents within the VDR, letting business valuation contributors collaborate and communicate more effectively in one centralized place.

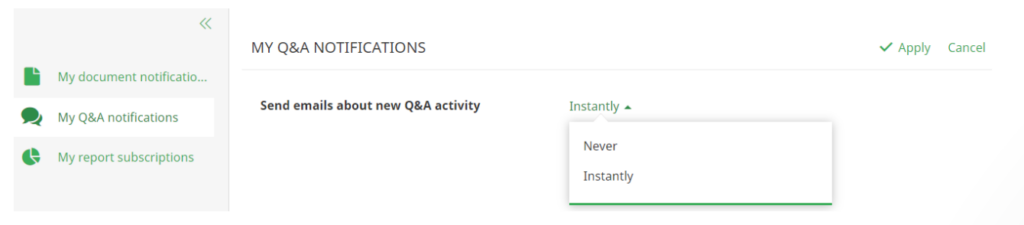

11. Automatic question assigning allows assigning inquiries directly to experts without the need to route them manually.

3 methods of business valuation

There are different methods of valuing a business and each has its own advantages and disadvantages. Below you’ll find the most common ones.

1. Asset-based valuation

Asset-based valuation approach is a generally accepted valuation method, which can be represented in the following formula:

total assets – total liabilities = business value

Thus, the asset-based approach assumes that the value of a business is equal to the cost of the total company assets minus any liabilities.

There are two types of company assets:

- Tangible assets. These are physical assets like cash, inventory, property, plants, and equipment. Their market worth is easily estimated using the book value approach — by subtracting the total liabilities from the total assets.

- Intangible assets. These are non-physical assets, like intellectual property, copyrights, patents, and trade secrets. Their estimation is more complex and requires more data and analyst effort.

There are two approaches to the asset-based valuation method:

- Liquidation value approach is used when a company is in financial difficulty or is expected to be liquidated. In this case, its worth equals its current market value or the estimated value it would fetch if it sells its assets.

- Going concern approach is used when valuing a healthy company that is expected to continue operating and generate revenue. In this case, its worth equals its replacement cost or current market value. This approach is often applied for M&A preparation.

| Pros | Cons |

| Straightforward and accessible to people who aren’t experts in business valuation. Most useful for companies having many tangible assets, such as manufacturing or real estate firms. | Less beneficial for organizations with few tangible and many intangible assets, such as technology or service-based companies. |

2. Income-based valuation

Income approach is another common business valuation method that estimates a business’s worth based on the future profits and income a company is expected to generate. This approach is most helpful to investors who want to calculate the possible benefits and risks of their investments.

Income-based valuation approach is divided into:

- Discounted cash flow (DCF) valuation. DCF analysis estimates a company’s future cash flows and discounts them back to their present value. The discounted cash flow method is best for young companies that have high future earnings prospects.

- Capitalization of earnings valuation. The method projects a business’s profitability by analyzing its expected value, cash flow, etc. This approach, unlike the DCF method, is most suitable for stable businesses and assumes that the business will remain profitable in the future.

| Pros | Cons |

| Provides insight into the company’s ability to generate profits. Can be customized to suit various types of businesses and industries. | Relies on hypotheses about future growth rate and other factors that may be tricky to predict accurately. Ignores non-income-based factors, such as brand recognition or competitive advantage. |

3. Market-based valuation

The market approach is a form of relative valuation and one of the most common methods of determining a company’s worth. It calculates the value of one business’s assets by comparing them to the value of similar businesses that have been sold or publicly listed.

The method is frequently used by the finance industry for preparation for M&A and other corporate transactions, as it provides relevant market data for valuing a business.

There are two approaches to market-based valuation:

- Public comparable company analysis compares the valuation metrics of a subject company to those publicly traded in the same industry. Even though the method is believed to be reliable, as it’s based on real market data, it’s important to ensure that comparable companies are truly similar in terms of size, growth prospects, or other factors.

- Precedent transactions analysis compares a subject company to other comparable companies that have recently been sold or acquired in the same industry. The approach is often used with other methods of valuation for a more accurate picture of a business’s worth.

| Pros | Cons |

| Relies on actual market data from similar companies, which makes the method objective and transparent. Relatively straightforward and easy to understand to people who aren’t experts in business valuation. | Only suits businesses that can access sufficient market data for accurate comparison. Businesses are often under- or over-valued because it’s difficult to find a truly similar company for an accurate value. |

What to consider before starting a business valuation?

Before choosing among business valuation methods most suitable for your needs, consider the following factors:

- Purpose of valuation. What valuation method to choose and what data to gather for the process significantly depends on the purpose of the valuation.

- Valuators. Who conducts the valuation is critical since the result will totally depend on the expertise and knowledge of valuation experts. Make sure they have experience in the industry that your business is in. Also, choose someone impartial and unbiased in their assessment so that the valuation is fair and reflects the true worth of your business.

- Business valuation standards. Business appraisers should follow the Uniform Standards of Professional Appraisal Practice (USPAP) and other standards set by the Institute of Business Appraisers (IBA) and the American Society of Appraisers (ASA). This will ensure the objectivity, consistency, and credibility of the valuation process.

- The term of the valuation report. The value of an asset can change over time and a new valuation may be necessary if significant changes occur. That’s why it’s recommended to conduct a company valuation not later than 3-6 months before a potential acquisition or sale.

- Documents. Commonly requested for business valuation purposes documents include financial statements for the current year and the last four to five years, lists of significant assets, and details of any liabilities. They should be stored and shared in a secure place, for example in a virtual data room.

- Business valuation cost. The cost to perform a professional business valuation can vary depending on factors such as business complexity, the size of the company, and the valuator’s qualifications. In general, it can range from $6,000 to $20,000.

Frequency of business valuations

The frequency of business valuations should be determined on a case-by-case basis since it significantly depends on the purpose of valuation. Here are some examples.

Rarely or never

Small stable companies that don’t intend to sell their businesses and aren’t expected to undergo significant changes in the near future, may not need to perform a valuation on a regular basis or even avoid doing it at all.

However, even if an organization doesn’t plan any important transactions, valuation can still turn out to be beneficial for strategic planning and improving profitability. In this case, performing business valuation every five to ten years may be worthwhile.

Every one to two years

As the economic climate changes frequently, influencing the financial situation of almost every business, many companies would benefit from an annual valuation analysis. More specifically, up-to-date information on the business’s worth would promote better financial planning and strategic decision-making.

Annual valuation is also necessary for companies seeking financing or participating in transactions or business activities that require updated information on what the business is worth.

On a regular basis

In some cases, companies perform regular business valuations as a part of their ongoing strategic planning. This helps them to track progress, identify areas for improvement, and stay ahead of the competition.

Frequent business valuations are also typical to startups experiencing significant success and companies growing fast in a short period of time. Having a clear understanding of the business’s value helps them to ensure they’re well-positioned for potential transactions and capital raising.

How often companies should conduct business valuations is summarized in the table below.

| Frequency of business valuation | Industry and size of a company |

| Rarely or never | Small stable companiesCompanies with small asset basesCompanies from stable and mature industries with little market volatility |

| Every one to two years | Companies regularly affected by market volatility Companies seeking to participate in a business transactionReal estate companies that suffer from fluctuations in property values and market trends |

| On a regular basis | Large companies engaged in high stakes activities and transactionsFast developing startups, in particular from tech industryCompanies operating in industries with high volatility or market uncertainty |

Key takeaways

Here are the most important takeaways from the article:

- A business valuation is a process of determining the economic value of a company. It’s mostly used for M&A preparation, fundraising, divorce proceedings, exit strategy, succession, and estate planning.

- The most common valuation methods are the asset-based method (including liquidation value and going concern approaches), income-based valuation method (including capitalization of earnings valuation and discounted cash flow analysis), and market-based valuation method (including public comparable company and precedent transactions analysis).

- Factors to consider before performing business valuation are the purpose of valuation, professionalism of valuators, valuation standards, and valuation cost.

- The frequency of valuation depends on its purpose, the size of a company, and its industry. Small stable companies may perform it rarely or avoid it at all, while businesses with many assets from industries with high volatility are advised to do it on a regular basis.

A competent and accurate business valuation can provide several benefits for every company. For example, it can help identify potential risks and areas for improvement, which will ultimately lead to growth and better profitability.

That’s why companies are recommended to collaborate with experienced appraisers, seek professional advice, and take advantage of modern software that can simplify and streamline the process.

Recommended for you