DealRoom Software

DealRoom data room overview

DealRoom is an M&A management platform by DealRoom Inc, an American software provider established in 2012 and headquartered in Chicago, Illinois, USA. DealRoom is an all-in-one business platform that helps companies raise funds, close M&A deals, and collaborate smarter and faster.

The company hasn’t been acquired or rebranded. It is also featured on the M&A Science network, a podcast platform for dealmakers.

DealRoom will suit a business of any size in the merger-and-acquisition stage as it streamlines respective processes.

The company offers a 14-day free trial – you can request it on the company website by reaching out to the customer support representative. Customers can also schedule a free 30-minute video demo of the platform features.

- 5GB data storage

- Project Management Features

- Data Room Features

- 20GB data storage

- Project Management Features

- Data Room Features

- Customize logo and colors

- Custom reporting

- 50GB–1TB data storage

- Project Management Features

- Data Room Features

- Customize logo and colors

- Custom reporting

- Private Instance

DealRoom pricing: DealRoom provider offers three pricing solutions: Single Room, Professional, and Enterprise. Users have the option of paying monthly or annually. Monthly prices start at $1,250 for the Single Room plan and $3,000 for the Professional plan. Contact DealRoom to request a custom quote for their Enterprise plan. The price of the DealRoom VDR software is on the medium-high side as compared to other providers in the same category. Most users point out that the prices are more cost-effective for long-term projects. The two-week free version allows customers to test the product. DealRoom provider is a popular choice of a virtual data room for medium and large businesses. It is an M&A lifecycle management software designed for collaboration and responsiveness. It specializes in providing a deal on the basis of digital platforms and is suitable for any business size clients. DealRoom managers guarantee high-level technical support, full customer maintenance during the transaction. This is a high price provider that’s why DealRoom VDR services are appropriate for middle or large-sized businesses.

Advantages

- Users report high connection speed during bulk uploads and downloads

- The ability to track individual requests helps users capture more details in project monitoring

- Users enjoy informative system notifications

- Users appreciate the ability to readjust the document index order

Things To Consider

- Technical customer support can take up to 30 minutes to respond

- File structures with multiple subfolder layers are difficult to navigate

- The difference between price tiers may be sharp for some users

- There are only 4 permission levels compared to 8 levels in competitor VDRs

dealroom software solutions

DealRoom virtual data room is the only product featured by DealRoom Inc. Designed for M&A deals, post-merger integration, IPO, and due diligence, DealRoom has the following features.

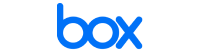

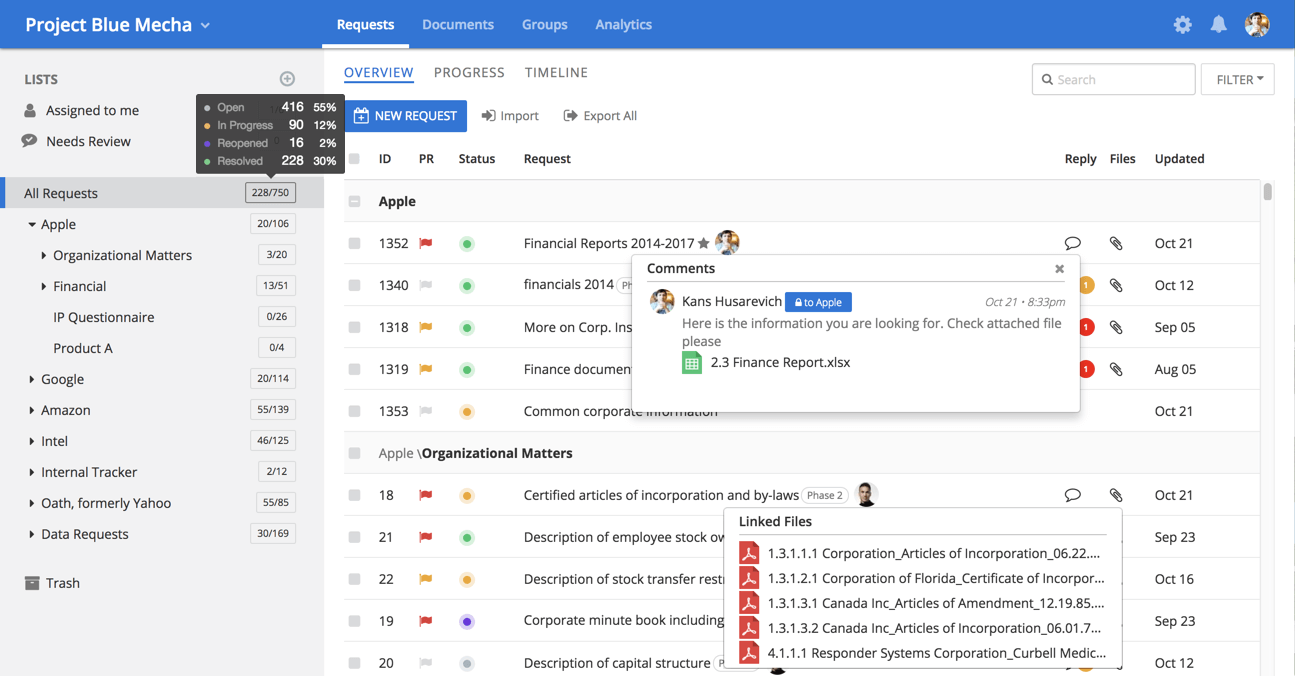

Document management

DealRoom features a full-fledged data room for secure document storage and exchange. The document repository allows you to upload files and folders in bulk using a drag-n-drop feature. Besides it, DealRoom has the following capabilities:

- Secure document viewer. You can open DOCX, XSLX, PPTX, PDF, and image files using a dedicated viewer with customizable access permissions. You can also upload other files, but the system won’t open them.

- Built-in document search. Thanks to this feature, you can search for important content using keywords and phrases.

- A clean document index. DealRoom features a convenient document structure with files stored in folders and subfolders. You can rearrange the index items however you want using a drag-n-drop feature.

Due diligence online

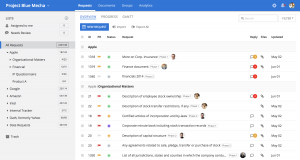

With Dealroom data room software, businesses can manage due diligence processes on a single platform without switching between data rooms, emails, or bulky Excel sheets. DealRoom offers the following diligence capabilities:

- Diligence request items. You can attach files and upload new documents to request items using drag-n-drop. They will appear in the request item and the chosen folder in the data room.

- Document redaction. You can redact documents in real-time and manage document versions. Edit personally identifiable information and set custom access permissions in real-time.

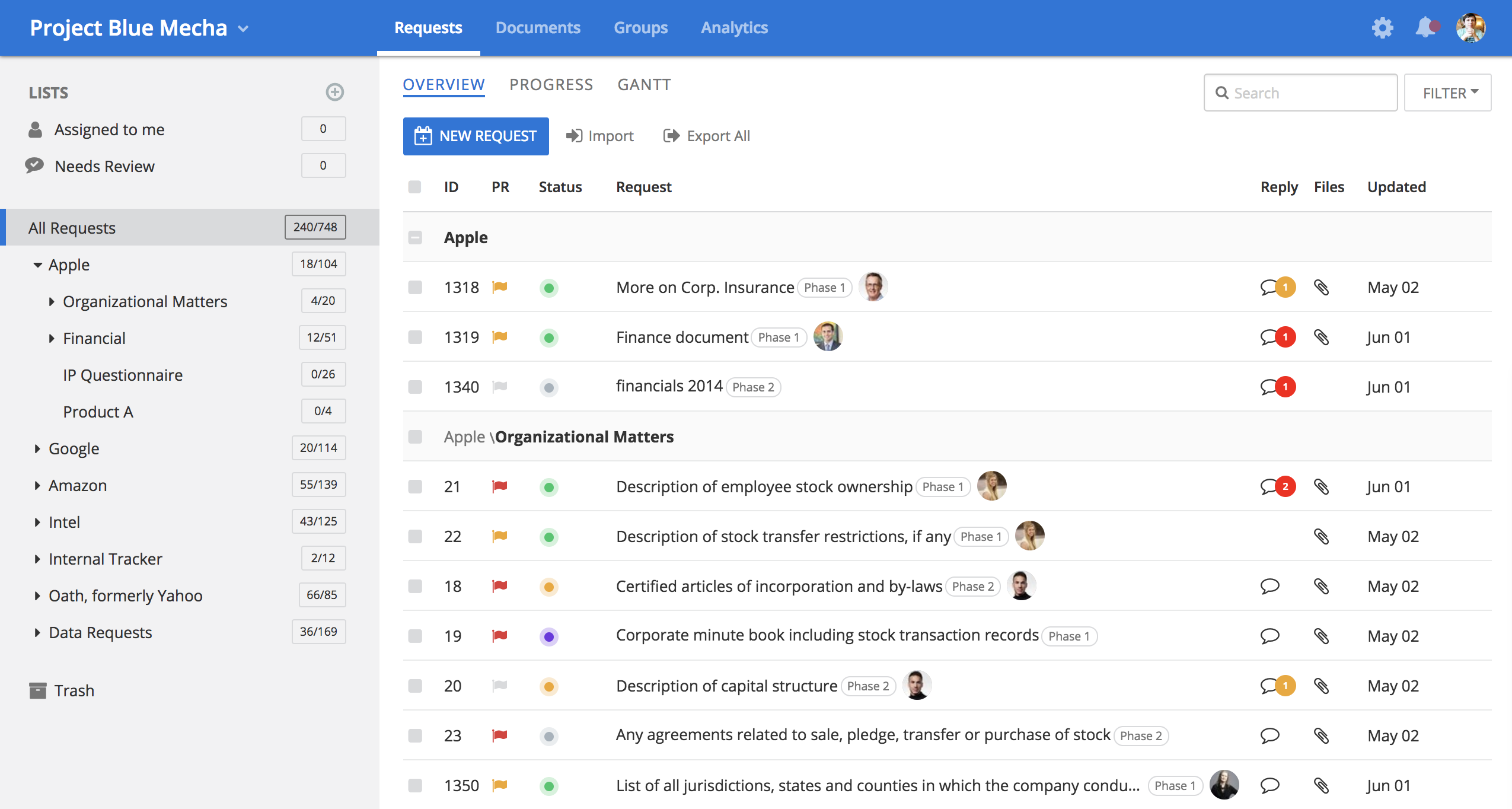

- Collaboration functionalities. You can update request properties: status, priority, due date, labels, assignees, followers, etc. You can also track user activity, assign properties to diligence items in bulk, locate them using filters, and leave comments.

Deal pipeline management

DealRoom allows you to manage as many deal projects as you need. You can access them via the pipeline management dashboard – an audit of your projects and associated data rooms. The pipeline management dashboard offers the following functionalities:

- Project metrics tracking. Keep tabs on deals’ statistics: value, size, industry, revenue, status, close date, etc. You can also track members involved in your projects.

- Project management. Create deals and respective data rooms and customize the pipeline dashboard to receive and track deal data most comfortably. You can also distribute announcements across members and search for projects using filters.

DealRoom reporting

DealRoom allows you to create custom reports across all levels of your project, from the pipeline to individual documents. The reporting interface offers the following features:

- Pipeline reports. Generate reports on project stage and history. Track information recorded in activity fields by date and manage projects by phase, status, type, industry, location, etc.

- Data room analytics. You can track user engagement and data room performance by group (admins, investors), folder, and document. Analyze activity in uploaded, viewed, and downloaded documents.

- Report customization and export options. You can create custom fields and graphs to see how your projects perform over time. Export the generated reports to Excel and PDF and share them across your teams.

Security features

DealRoom applies industry-leading security features in the following areas:

- Login security. DealRoom enables two-factor authentication, single sign-on (SSO), and unique user IDs to prevent any unauthorized access to the data room.

- Data protection. The platform uses 256-bit data storage encryption and connection encryption for data transit. The company stores customer information on private cloud servers and conducts regular vulnerability and malware scans.

- Data room privacy. You can control data privacy across all data room levels, from projects to documents. Apply watermarks, grant customizable permissions to users, and disable printing, downloading, viewing, and editing rights for selected files and diligence cards.

what areas is dealroom best for?

DealRoom VDR is the best solution for M&A deals and associated processes like due diligence, audits, group collaboration, etc. You can also repurpose the VDR functionalities for IPO, divestment, bankruptcy and restructuring, and more.

DealRoom customers use the platform to share files, collaborate with investors, prepare legal documents, conduct business audits, and more.

Assuming rich data management functionalities, DealRoom will suit many industries, including but not limited to finance, government, healthcare, corporate, and energy.

compliance certificates

DealRoom complies with the following standards:

- GDPR

- SOC 1 and SOC 2 Type II

- ISO 9001 and ISO 27001

- DoD CSM Level 5

- PCI DSS Level 1

- FIPS 140-2

dealroom’s advantages

DealRoom is a viable option for complex business processes, but these extra perks make it especially beneficial:

- App integration. You can connect DealRoom to Slack, Salesforce, Microsoft Teams, Idaptive, Okta, and Google products.

- Pre-made workflow templates. DealRoom speeds up workflow organization with pre-build templates for due diligence, post-merger integration, IPO, etc.

- Reliable customer service. DealRoom’s customer support team replies promptly via online chat, email, and phone.

- API support. Businesses use DealRoom’s API to transfer files from their internal project management tools to the VDR and update their employees on respective changes.

reviewing dealroom’s customers

DealRoom helps over 2,000 businesses worldwide. Many clients come from the United States, Canada, and Europe. They use DealRoom to close M&A deals, optimize post-merger integration, raise funds, and more. DealRoom’s solutions help businesses of any size in the legal, government, energy, and other sectors.

As for DealRoom’s website traffic, it attracts over 140 thousand visitors – most of them come from South Africa (22.82%), the United States (18.93%), India (11.93%), and the United Kingdom (11.14%).

DealRoom helped these prominent companies and organizations in the following industries:

- Investment banking – Morgan Stanley

- Corporate – Analog Devices

- Biotech – Teladoc Health

- Energy – Emerson

- Government – Canadian National Railway

- Real Estate – Vonovia

- Private Equity – Auxo Investment Partners