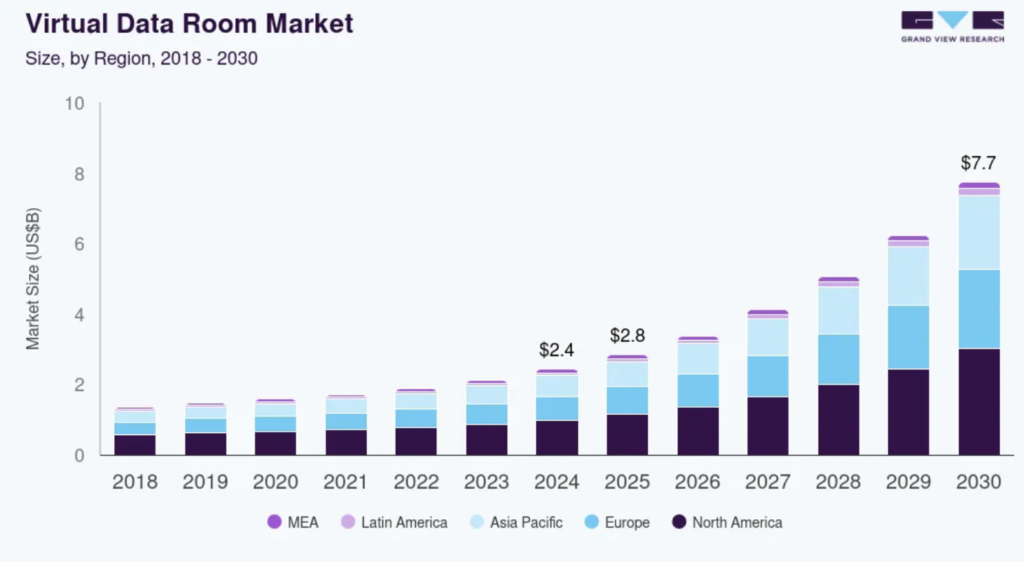

The global virtual data room market reached $2.9 billion in 2024 and is expected to grow to $7.6 billion by 2033, with a compound annual growth rate of 11.36% during the forecast period.

What is driving the increase in data room market share? What trends and forecasts are shaping its future? What are the top VDR players to choose in 2025?

Find the answers in our post and stay on trend!

| Report coverage | Details |

| Market revenue in 2024 | $2.9 billion |

| Estimated revenue by 2033 | $7.6 billion |

| Forecast period | 2024-2033 |

| Growth rate | 11.36% |

| Main drivers of data room market growth | Rising data breaches, Regulatory compliance, Increase in mergers and acquisitions, Growth of the renewable energy sector |

| Main data room market segmentation factors | Component, Deployment type, Enterprise size, Business function, Vertical |

| Key players of the virtual data room industry | Ideals Solutions Group, Citrix Systems, Inc., Intralinks Holdings, Inc., Merrill Corp./Datasite, Ansarada |

What are the main drivers of data room market growth?

Virtual data rooms are becoming essential tools for businesses worldwide due to the following factors:

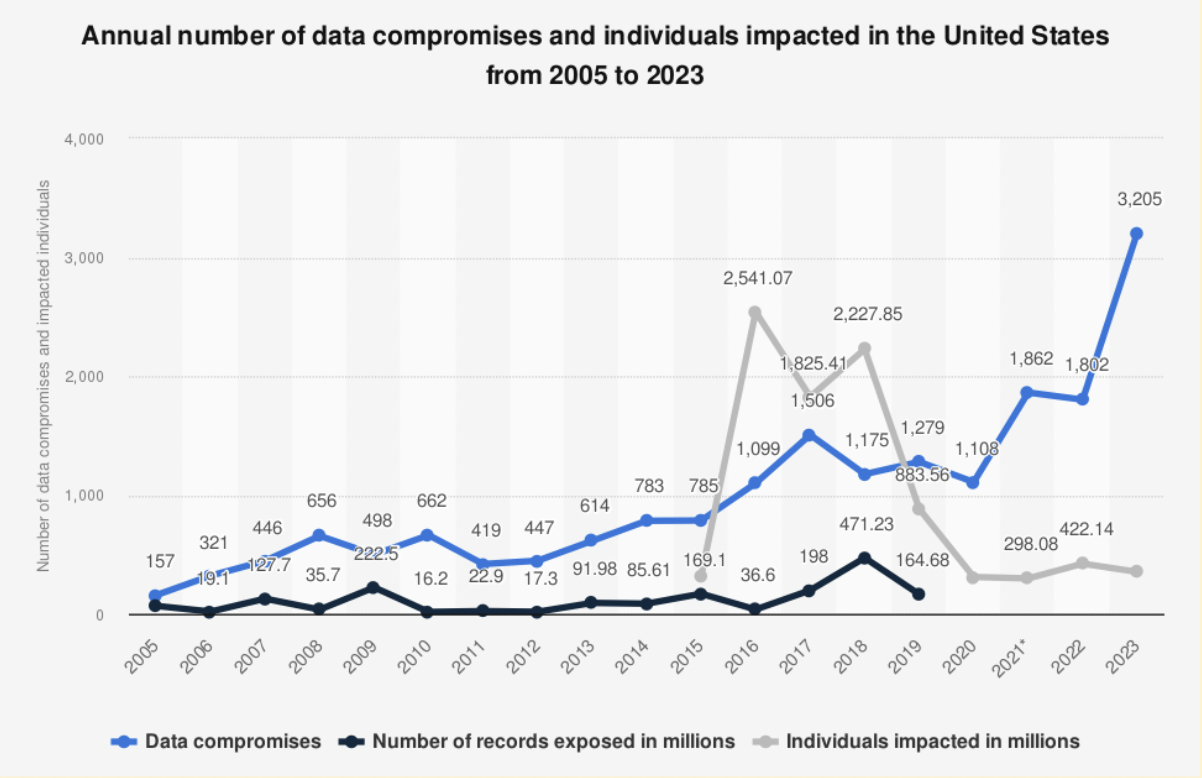

1. Rising data breaches

The global average cost of a data breach in 2024 has risen by 10% compared to the previous year, reaching the highest total on record. Organizations adopt virtual data room solutions to ensure confidentiality and comply with data protection laws. The software provides robust security features like encryption, multi-factor authentication, and granular user permissions, reducing the risk of unauthorized access and maintaining data integrity.

2. Strict regulatory compliance

Data protection regulations, including GDPR, CCPA, and HIPAA, set strict data storage and sharing security requirements. VDRs help companies stay compliant by providing complex tools for managing sensitive documents and ensuring accountability and auditability.

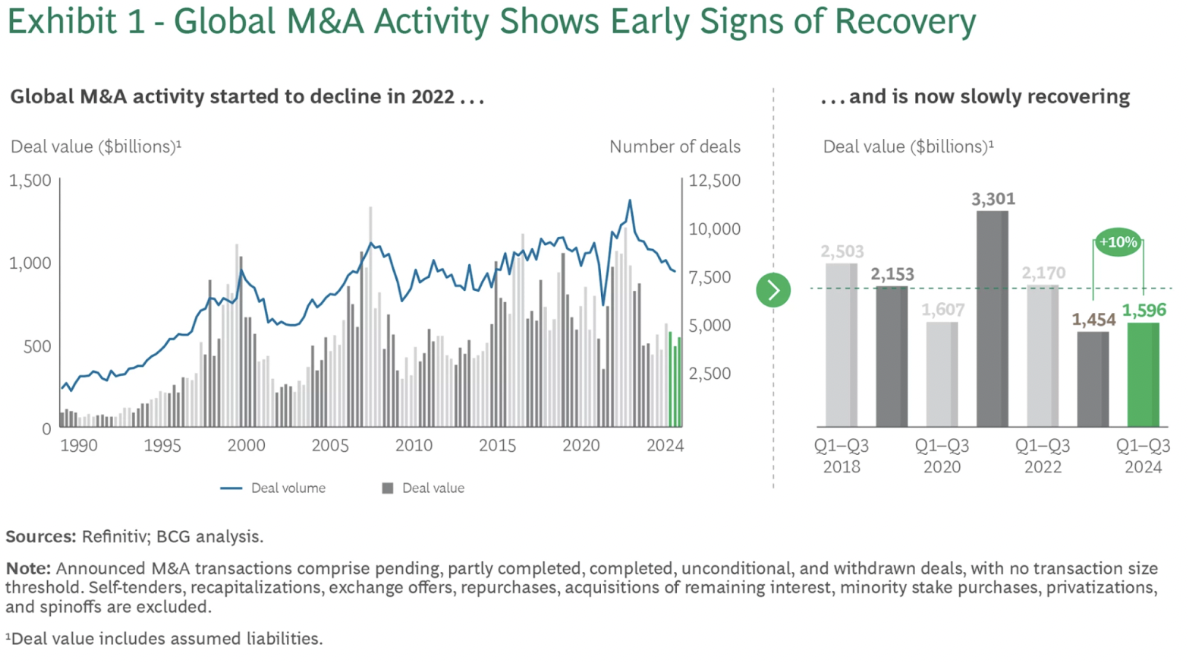

3. Increase in mergers and acquisitions

The rising number of M&As across industries contributes to the demand for data rooms. Companies use the software during M&A activities to securely share files, manage critical data, and enable effective communication between parties worldwide.

4. Growth of the renewable energy sector

As the global shift toward sustainable energy sources continues, virtual data rooms support the industry’s growth, streamlining project development, protecting intellectual property, and ensuring compliance with regulatory requirements.

Virtual data room market segmentation

IMARC Group analyzes the key trends across various segments of the global virtual data room market, along with forecasts for global, regional, and country-level growth from 2025 to 2033. The report segments the market by component, deployment type, enterprise size, business function, and industry vertical.

1. By component

- Solution

Cloud-based solutions represent the largest segment of the virtual data room market. They address the needs of various industries by offering scalability, accessibility, and robust security. Their subscription-based pricing model is attractive to organizations of all sizes, eliminating the need for significant upfront infrastructure investments.

- Services

The services component of the VDR market includes offerings for implementing, managing, and maintaining virtual data rooms. These services help organizations maximize the effectiveness of VDR solutions by assisting with setup, ongoing management, and customization to meet specific business needs.

As remote work increases and data security concerns rise, cloud-based data rooms remain market leaders, providing essential tools for secure data management, communication, and compliance across industries worldwide.

2. By deployment type

- Cloud-based

Cloud-based virtual data rooms have gained significant traction in the market due to their scalability, flexibility, and cost-effectiveness. These solutions are particularly beneficial for organizations requiring easy access and the ability to scale operations without extensive on-site infrastructure. However, despite their popularity, cloud-based virtual data rooms haven’t overtaken on-premises solutions in some industries.

- On-premises

On-premises data room solutions still hold a share of the global market, particularly in sectors with stringent data security and compliance needs, such as banking and healthcare. VDRs provide organizations with complete control over their sensitive data by storing it within their physical infrastructure. Therefore, enterprises focusing on data security and compliance often prefer on-premises solutions.

While cloud-based VDRs continue to rise in popularity, on-premises solutions remain a key choice for companies requiring greater data control.

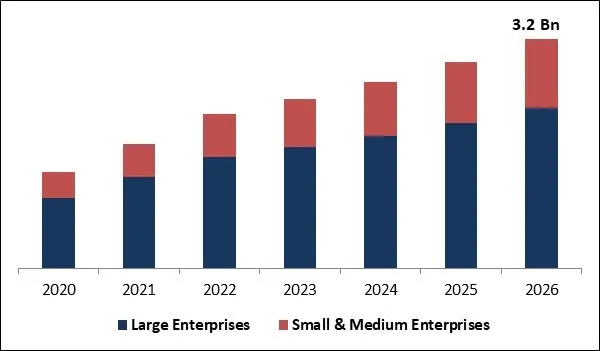

3. By enterprise size

- Large enterprises

Large enterprises dominate the virtual data room market due to extensive data management needs, complex workflows, and stringent security requirements. In particular, these organizations use VDRs for secure document exchange, due diligence, M&A operations, and compliance tasks.

- Small and medium enterprises

Small and medium enterprises also use virtual data rooms, although their requirements differ from those of large enterprises. SMEs typically need cost-effective, scalable solutions that provide essential data security without the complexity and infrastructure demands of larger systems.

As digital transformation speeds up and data becomes increasingly valuable, large enterprises will drive the demand for advanced virtual data room solutions to meet their needs and challenges.

4. By business function

- Marketing and sales

Marketing and sales companies use virtual data rooms to share confidential data securely, collaborate with stakeholders, and manage contracts and agreements. The software supports these teams by ensuring data privacy and streamlining the exchange of information, which is essential for successful sales operations and marketing initiatives.

- Legal

As efficient data management solutions, VDRs play a crucial role in managing sensitive legal documents, conducting due diligence, and streamlining mergers and acquisitions in the legal sector. Thus, legal teams employ data rooms to stay compliant, maintain confidentiality, and simplify the review of confidential documents.

- Finance

The finance sector represents the largest segment of the data room market. With the industry’s high-stakes transactions, strict regulations, and sensitive data management requirements, dataroom platforms become essential for secure document sharing, due diligence, mergers and acquisitions, and financing.

- Workforce management

Workforce management professionals use the solution to manage sensitive employee information, contracts, and compliance documents. The software streamlines the exchange of HR-related documents and maintains privacy and security standards across organizations.

With the shift of financial transactions to digital platforms, the demand for finance-specific VDRs as secure data management solutions grows.

5. By vertical

| BFSI (Banking, Financial Services, and Insurance) | The industry’s critical need for secure data management, compliance, and confidential transactions makes virtual data room software essential for supporting mergers and acquisitions, due diligence, financing, and regulatory procedures. |

| Retail and e-commerce | VDRs in this industry help secure sensitive customer data, manage supply chains, and streamline transactions. In particular, data rooms support businesses in handling large volumes of data securely and ensure compliance with privacy laws and regulations. |

| Government | In the government sector, online data rooms provide a secure platform for confidential information related to national security, public administration, and intergovernmental agreements. The software protects sensitive data from unauthorized access. |

| Healthcare and life sciences | The healthcare and life sciences sector uses VDRs to protect sensitive patient data, manage clinical trials, and handle regulatory compliance. The software supports secure data sharing between researchers, healthcare providers, and regulatory bodies and provides robust security. |

| IT and telecommunications | IT and telecommunication professionals employ data rooms to manage vast amounts of data, simplify mergers and acquisitions, and comply with industry regulations. In addition, the solutions help companies maintain operational efficiency and secure sensitive intellectual property and customer information. |

The ongoing tech-driven changes and global growth of the BFSI sector drive strong demand for VDR solutions.

What are virtual data room market trends?

Now, let’s see what awaits the virtual data room market in the years to follow:

- The rapid growth of cloud-based VDRs

- The predominant position of the BFSI industry

- AI-powered virtual data room

1. The rapid growth of cloud-based VDRs

According to Zippia, 67% of business IT infrastructure was cloud-based in 2022. Additionally, the amount of corporate data stored in the cloud increased by 10% from 2021 to 2022. It’s a quantum leap compared to a 5% increase from 2018 to 2021.

Cloud transformation will likely continue beyond 2023. The virtual data room industry offers cloud-based solutions with the following advantages:

- Immediate access through the internet

- Lower infrastructure costs compared to on-premise sites

- 24/7 support and maintenance

- Easy implementation

Gartner predicts that 75% of businesses will adopt virtual data centers, virtual data rooms, and cloud-based business models by 2026 based on the above benefits.

2. The predominant position of the BFSI industry

Allied Market Research published a qualitative and quantitative analysis of the virtual data room market, outlining its verticals. According to the report, the market is divided between:

- BFSI

- Retail and e-commerce.

- Energy and tilities

- Healthcare

- IT & Telecom

- Construction & Real Estate

- Other

According to the report, the banking, financial services, and insurance (BFSI) sector is currently outpacing other industries. Moreover, it is projected to remain predominant until 2026.

These findings align with other reports. For instance, the Verified Market Research report attributed 26.15% of the VDR market share to BFSI in 2021. It is expected to grow at a CAGR of 15.81% during the 2022-2030 forecast period.

3. AI-powered virtual data room

In 2019, the solution segment accounted for over 70% of the global revenue share. This was caused by a rapidly growing demand for VDR software across numerous spheres, including M&A activities, fundraising, financial audits, and many others.

With such a significant focus on the VDR solution segment, leading market players are concentrating their forces on developing AI-powered VDRs.

According to a recent report by Grand View Research, it is estimated that the AI-powered segment of VDRs will grow at a CAGR of nearly 20% between 2020 and 2027.

Competitive landscape: What are the key players of the virtual data room industry?

Let’s define key leaders of the virtual data room market and see what drives their popularity and growth.

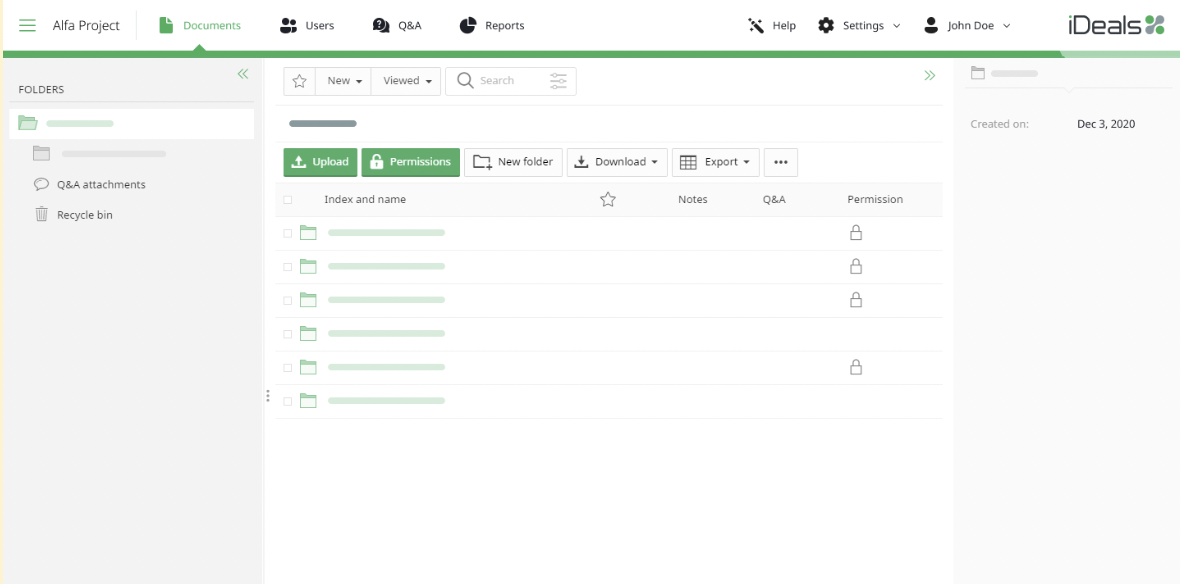

1. Ideals Solutions Group

Ideals Solutions Group is a data room software company that provides online file management services and streamlines M&A business processes. Its primary product is Ideals VDRs, service-supported virtual data rooms used by businesses in more than 30 countries.

Ideals develops secure data storage tools and search functionality for sensitive documents. The company assists in secure document management for sectors of investment, legal, and life sciences.

In 2019, Ideals acquired Boardmaps, a board management software vendor. Ideals also made considerable improvements during 2021-2023, gaining over a million users in 175,000 companies.

Ideals VDR became the Frontrunner of 2022 at SoftwareAdvice and one of the key market players. The most prominent Ideals customers include Deloitte, Accenture, KPMG, and Citi.

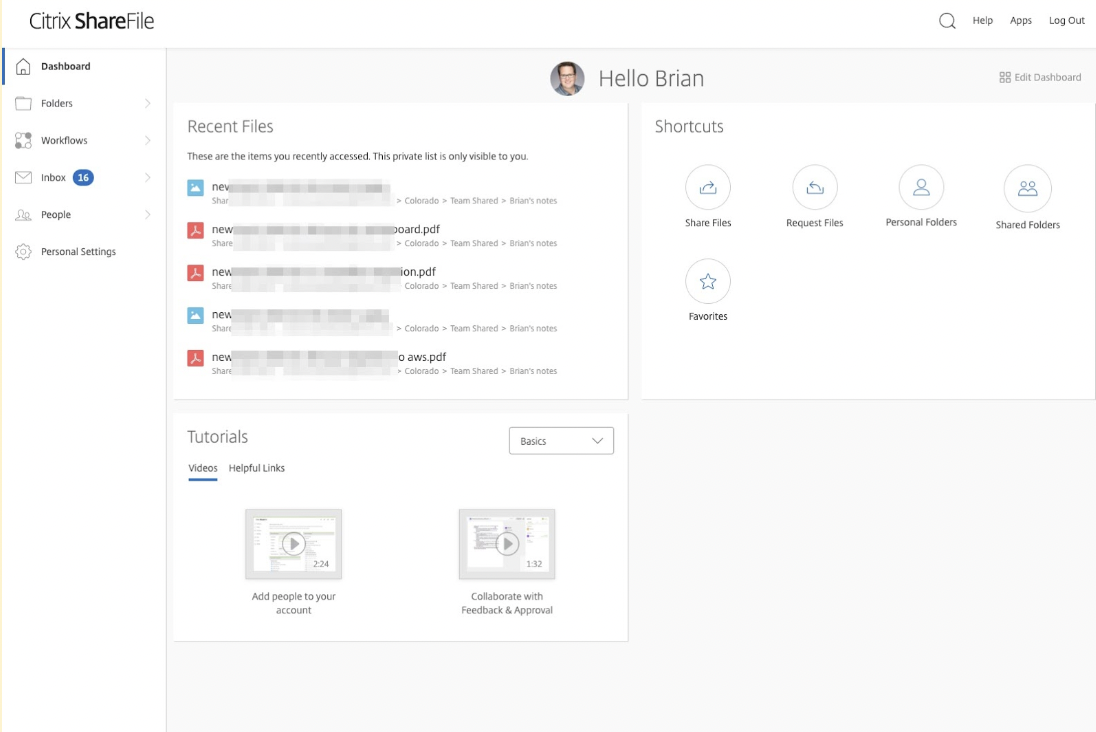

2. Citrix Systems, Inc.

Citrix Systems, Inc. develops information technology solutions with all the design, development, and marketing stages. It provides enterprises with delivery networking products and workspace services solutions.

In 2018, Citrix Systems announced its Citrix SD-WAN service and Citrix ADC, application delivery controller, to help network service provider (NSP) partners and managed service providers (MSPs).

In 2021, Citrix Systems acquired Wrike, a project management tool, for $2.25 billion. Wrike contributed to the Citrix Systems technology stack, improving its VDR services and attracting new customers. Citrix Sharefile, a branded virtual data room, serves over 65,000 corporate customers as of 2023.

Colliers International, Messer Construction, and SCL Health are prominent Citrix Sharefile customers.

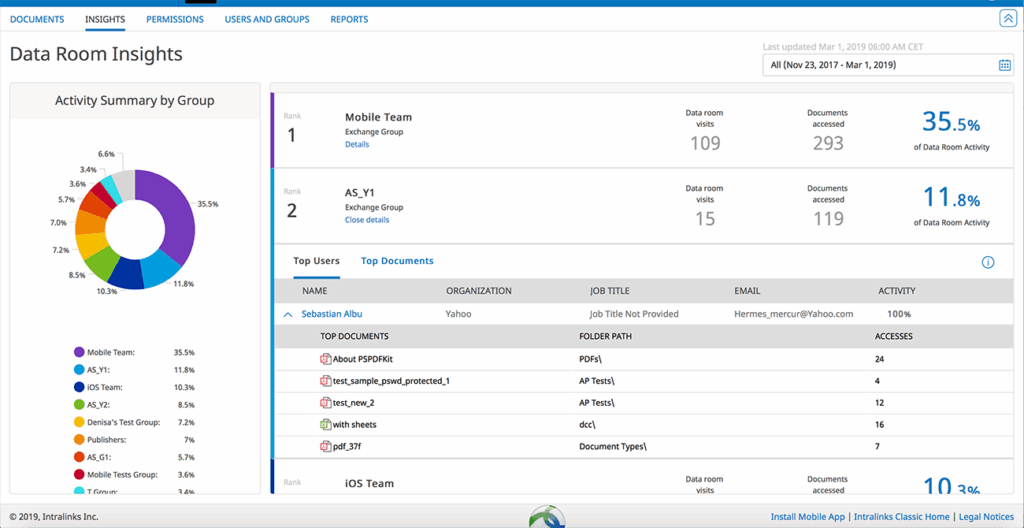

3. Intralinks Holdings, Inc.

Intralinks is a provider of collaboration software and security solutions for online document sharing. The company provides cloud-based financial technology, global banking, and deal-making.

Besides keeping a solid position in the banking industry, IntraLinks also caters to other fields, like real estate or deal marketing. Its partners include Black & Callow, Broadridge, and Kira. Among its customers are Starbucks, Hailiang Education, and Globalvia.

Intralinks’s latest deal was an acquisition of Verilume, a cloud infrastructure company, in 2016. This acquisition helped Intralinks strengthen security compliance and reach new audiences.

Notable Intralinks customers include Goldman Sachs, Whole Foods Market, and L’Oréal Group. As of 2023, Intralinks serves at least 1,200 corporate clients, mostly large enterprises.

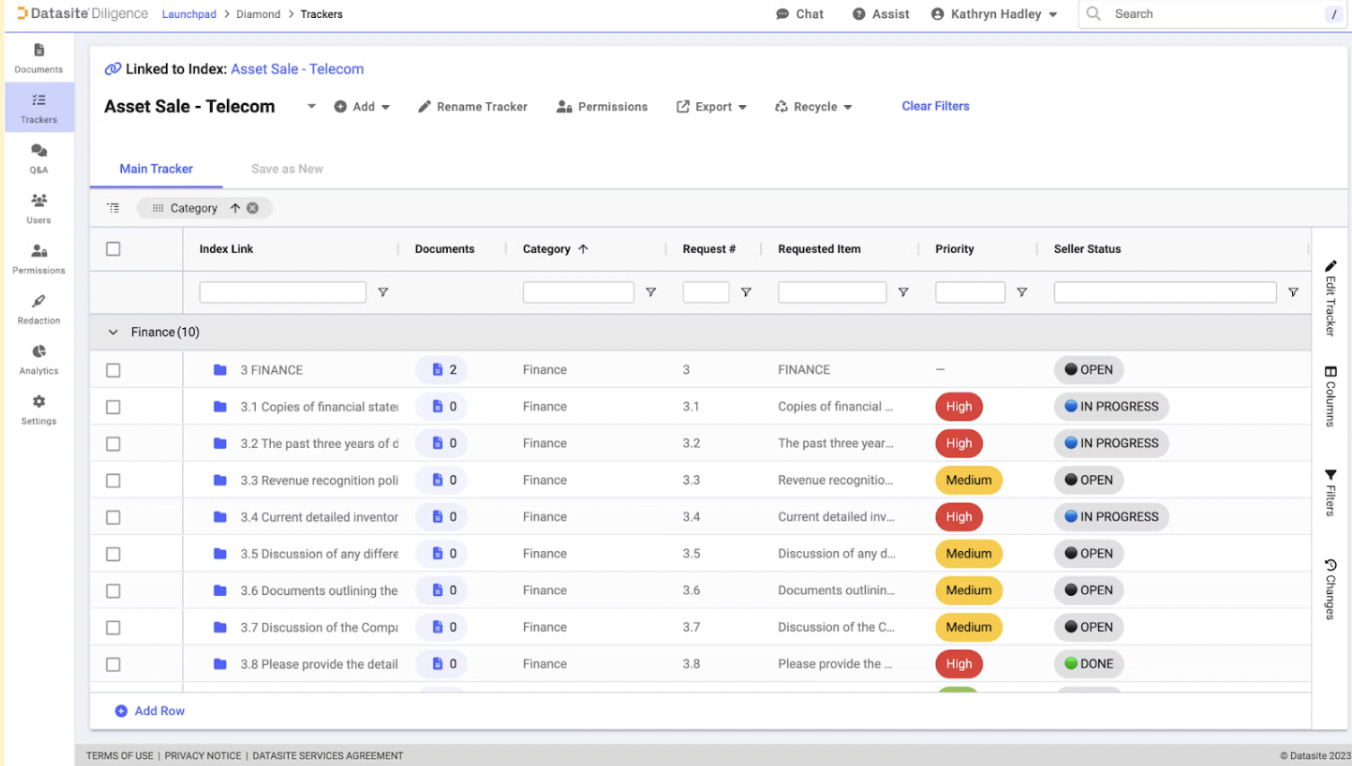

4. Merrill Corp./Datasite

Datasite, also known as Merrill Corp., is a developer of SaaS platforms for the M&A industry. They work throughout the whole M&A lifecycle, covering all the necessary stages:

- Marketing and engagement

- Detailed analysis and due diligence

- Closing and post-merger integration

The company was founded in 1968 as a Merrill Corporation. However, in 2020 it announced the rebranding to Datasite, renewing not only the company’s name, logo, and website but also its due diligence application.

In 2021, Datasite acquired Firmex, a Canadian virtual data room provider. This acquisition supported Datasite’s growth strategy and helped it enter the Canadian VDR market. As of 2023, Datasite enumerates 3 million users from 13,000 companies in 180+ countries. Notable Datasite customers include E*Trade, Duff & Phelps, and Morgan Stanley.

5. Ansarada

Australian-based Ansarada develops a virtual data room platform designed to offer information on M&A activities. Their main advantage involves implementing artificial intelligence tools and machine learning techniques.

Such solutions simplify the deal-related processes and streamline all the needed preparations. In 2020, Ansadara merged with Thedocyard, another Australia-based SaaS VDR provider, and raised $12 million in funds.

In 2020, Ansarada also launched a Smart Upload tool that automatically allocated files to the data room.

Ansarada remains a solid player in the Australian VDR market, serving over 10,000 companies as of 2023. Its prominent clients include VISA, CVC Capital Partners, and Glencore.

Key takeaways

Here are the most important takeaways from the article:

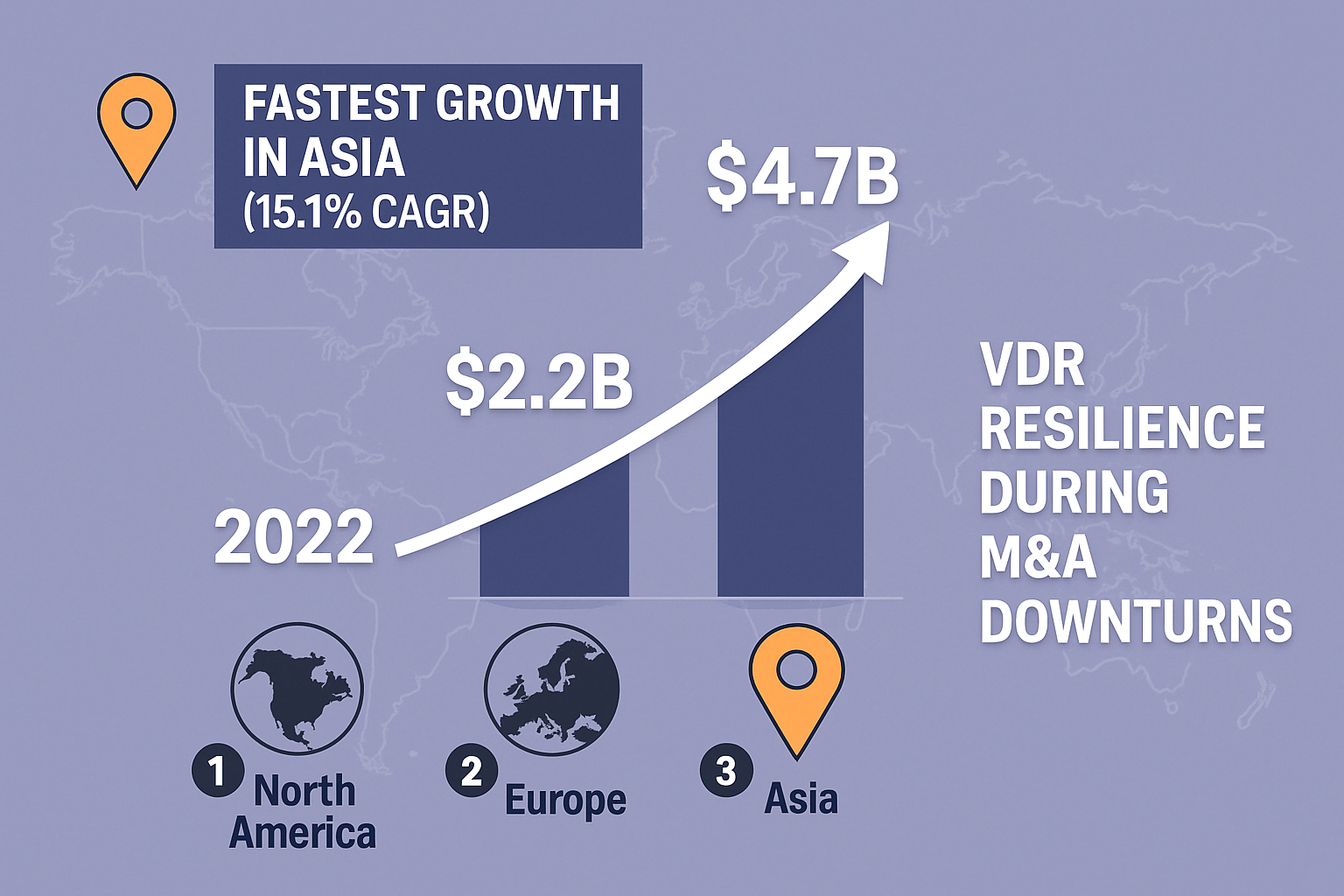

- Global M&A activity and the VDR market move in tandem, but VDR adoption proves resilient even during economic downturns. Despite all-time lows in M&A activity in 2020 and again in 2022-2023, the virtual data room market continued to grow steadily.

- Strong growth outlook: The global VDR market is set to expand at a CAGR of 13.9%, increasing from $2.2 billion in 2022 to $4.7 billion by 2028.

- Regional leadership and shifts: North America will remain the world’s largest VDR market throughout the forecast period. Europe holds steady in second place, while Asia is poised to overtake other regions—becoming the third largest market and narrowing the gap with Europe.

Ideals, Citrix Systems, Intralinks, Datasite, and Ansarada are among the key players in the competitive landscape, according to our primary research. Ideals represents the biggest customer base in the VDR industry as of 2023, serving over 175,000 corporate clients.

References

- “Virtual Data Room Market – Growth, Trends, Covid-19 Impact, And Forecasts (2021 – 2026)”. Mordor Intelligence.

https://www.mordorintelligence.com/industry-reports/virtual-data-room-market - Feb, 2020. “Virtual Data Room Market: Global Opportunity Analysis and Industry Forecast, 2019–2026.” Allied Market Research.

https://www.alliedmarketresearch.com/virtual-data-room-market - Sep, 2020. “Virtual Data Room Market Size, Share & Trends Analysis Report, 2020-2027.” Grand View Research.

https://www.grandviewresearch.com/industry-analysis/virtual-data-room-market - “Virtual Data Room Market – Global Forecast to 2025.” Markets and Markets.

https://www.marketsandmarkets.com/Market-Reports/virtual-data-room-market-74439915.html - “Virtual Data/Deal Room (VDR) Market – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2019 – 2027”.

https://www.transparencymarketresearch.com/virtual-data-rooms-market.html - Feb 22, 2021. “Virtual Data Rooms Industry in the US – Market Research Report.” IBISWorld

https://www.ibisworld.com/united-states/market-research-reports/virtual-data-rooms-industry/ - “Mergers and acquisitions among top trends for 2021, says HBAA”. M&IT.

https://mitmagazine.co.uk/news/mergers-and-acquisitions-among-top-trends-for-2021-says-hbaa/ - Mar 9, 2021. “The 10 most innovative joint ventures of 2021”. Fast Company.

https://www.fastcompany.com/90600225/joint-ventures-most-innovative-companies-2021 - Anne Sraders. Jun 2, 2021 “M&A activity has already blown past the $2 trillion mark in a record-breaking 2021.” Fortune.

https://fortune.com/2021/06/02/mergers-acquisitions-2021-m-and-a-record-year-spacs/ - Mar 6, 2021. “Virtual Data Room Market May Set New Growth Story | Citrix (United States), Intralinks, Firmex, Ideals Solutions.” Menafn.

https://menafn.com/1102202311/Virtual-Data-Room-Market-May-Set-New-Growth-Story-Citrix-United-States-IntralinksFirmex-Ideals-Solutions - Feb 17, 2021. “An Expert Guide to Securing Sensitive Data: 34 Experts Reveal the Biggest Mistakes Companies Make with Data Security”. Digital Guardian.

https://digitalguardian.com/blog/expert-guide-securing-sensitive-data-34-experts-reveal-biggest-mistakes-companies-make-data - “2021 Cyber Security Statistics. The Ultimate List Of Stats, Data & Trends.” Purplesec.

https://purplesec.us/resources/cyber-security-statistics/ - “Virtual Data Room Market by Business Function (Marketing and Sales, Legal, Finance, and Workforce Management), Component (Software and Services), Deployment Mode, Organization Size, Industry Vertical, and Region – Global Forecast to 2025” Markets and markets.

https://www.marketsandmarkets.com/Market-Reports/virtual-data-room-market-74439915.html - “Virtual Data Room Market Size And Forecast.” Verified market research.

https://www.verifiedmarketresearch.com/product/virtual-data-room-market/ - Feb 11, 2021. “12 tech trends of 2021.” Newsletterest

https://newsletterest.com/message/48950/12-tech-trends-of-2021 - Apr 23, 2021. “Number of unicorns worldwide as of April 2021, by region.” Statista.

https://www.statista.com/statistics/1092626/number-of-unicorns-in-the-world-by-region/

Recommended for you