The commercial real estate picture for 2023 implies there may be issues ahead. The retail industry is at a turning point, and the future of office areas is uncertain. Furthermore, supply chain concerns linger and inflation is approaching 40-year highs. However, a few promising signs still exist in the commercial real estate acquisitions outlook.

Suppose you are in the acquisition of commercial real estate property, or it is coming soon. In that case, it’s time to raise the curtain on this critical project and do the following:

- Check the 2023 industry outlook

- Uncover the due diligence period specifics in the commercial real estate transactions

- Discover a cutting-edge solution for the safe and easy management of diligence documents

Scroll down and make things right to smooth the due diligence process out!

Commercial real estate in 2021-2023

According to CBRE, the global commercial real estate investment volume plummeted by 60% year-over-year to US$226 billion in Q4 2022. Investment declined by 62% in Europe, 63% in the Americas, and 29% in Asia-Pacific, mainly owing to higher interest rates and an economic downturn.

The economic climate by sector is as follows:

- The multifamily sector remained the largest, with US$61 billion in investment, a 72% decrease from the previous year.

- Office investment declined 57% to US$56 billion.

- Investment in industrial sectors plummeted 59% to US$49 billion.

- Retail investment plunged 53% in the fourth quarter to US$29 billion despite sustaining reasonably stable in the year’s first three quarters.

Full-year global volume in 2022 declined 20% year on year to $1.14 trillion, trailing only the record figure in 2021. Annual volume declined 27% to US$324 billion in Europe, 17% to US$698 billion in the Americas, and 19% to US$118 billion in Asia-Pacific. The first half of 2022 saw record investment, but activity dropped dramatically in the second half as a result of rising interest rates and economic instability.

As for 2023, monetary tightening and a mild recession are expected to hold back investment activity in the industry. However, despite all this, uncertainty is expected to decrease by the middle of the year, contributing to the growth of commercial real estate activity.CBRE is forecasting that the volume of global investment in 2023 will exceed the pre-pandemic maximum in 2019, but it will still decrease by 11%.

What is commercial real estate due diligence?

The due diligence process includes the analysis, inspection, or investigation by a buyer of a potential property before committing to a purchase contract. Proper due diligence should eliminate any post-transactional surprises.

Since buyers involved in CRE deals have less legal protection than buyers of residential property, they need to be more careful and attentive to the details when conducting commercial real estate due diligence during the acquisition of commercial real estate property.

To find the most suitable data room for the due diligence process, it is essential to outline the ultimate investment goal. There are three general categories to profit in CRE:

- Investment. The buyer acquires the commercial property with expectations to resell it at a higher price later on.

- Example: Buying a property in 2020 and selling it in 2025.

- RE development. The buyer aims to restructure or repurpose the building or the land to increase the asset’s value.

- Example: Purchasing an abandoned factory and renovating it into condominiums with office and retail facilities for lease.

- Business operations. The buyer intends to use the property to produce a profit.

- Example: Buying and operating a hotel to profit from travelers.

Defining the intention of the deal is key to streamlining the process and facilitating effective commercial real estate due diligence. The next step is to find trustworthy real estate management software.

Virtual data rooms for commercial real estate due diligence

Several factors make VDRs irreplaceable for due diligence in the real estate transactions: complexity, duration, number of people involved, security, and the need for digitalization.

On average, the due diligence process for commercial properties can take from one to three months — longer in some cases. And throughout this time, all parties have to be sure that all procedures are followed correctly and that financial information together with all related documents are kept and/or shared safely.

Check the best data room solutions

Here’s how a data room for real estate management can elevate the level thoroughness of CRE due diligence:

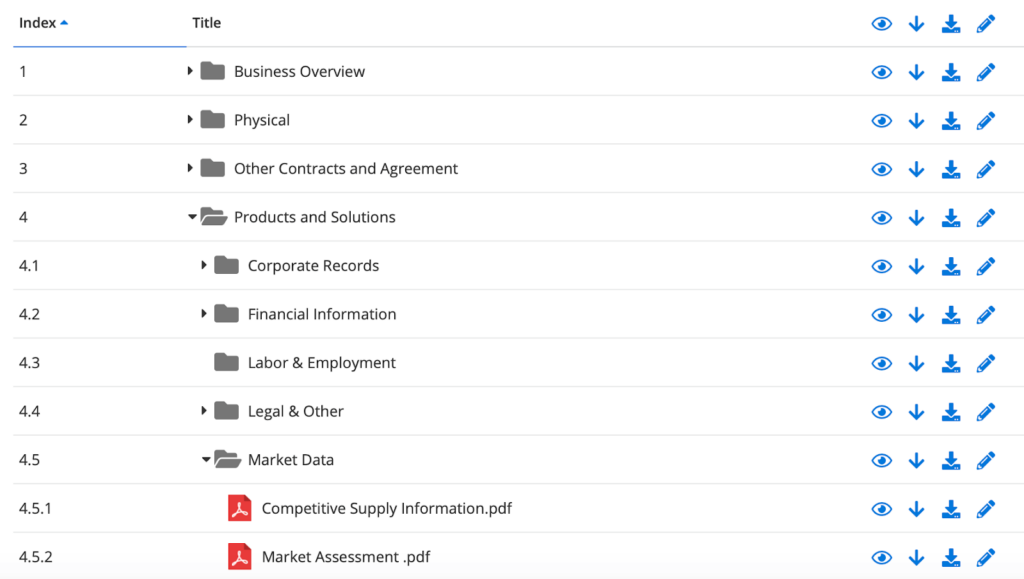

- Superb document organization with automatic indexing for having files readily accessible

- Access restrictions by role, location, time, and more

- Document protection through watermarking, fence-view, screenshot, and download limitations

- Customizable rights management

- Diverse platform adaptability for accessing commercial real estate due diligence anytime, anywhere

- Regulated data storage solutions and facilities

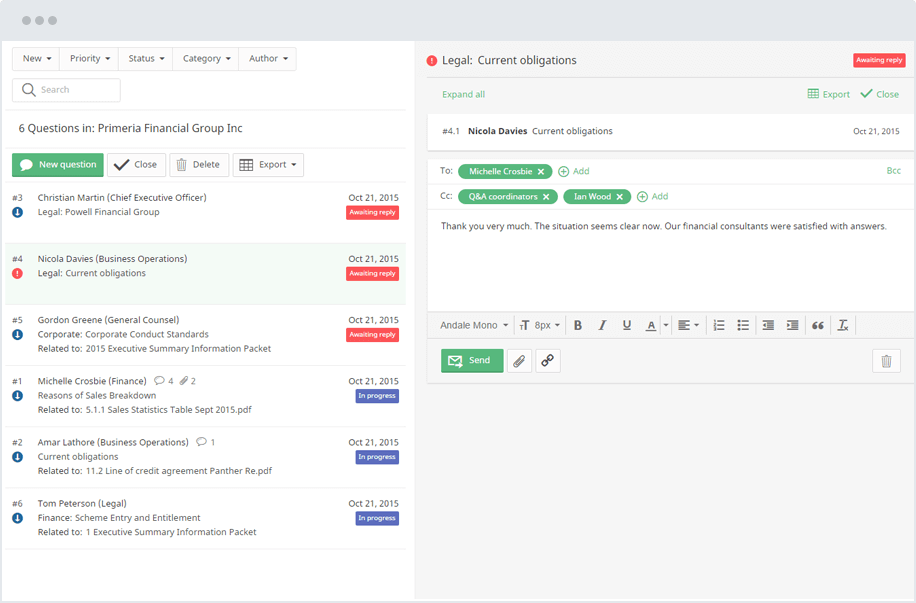

- Modern and convenient communication tools for discussion, data gathering, and informed decision-making

- User-activity reporting to monitor and stimulate the process

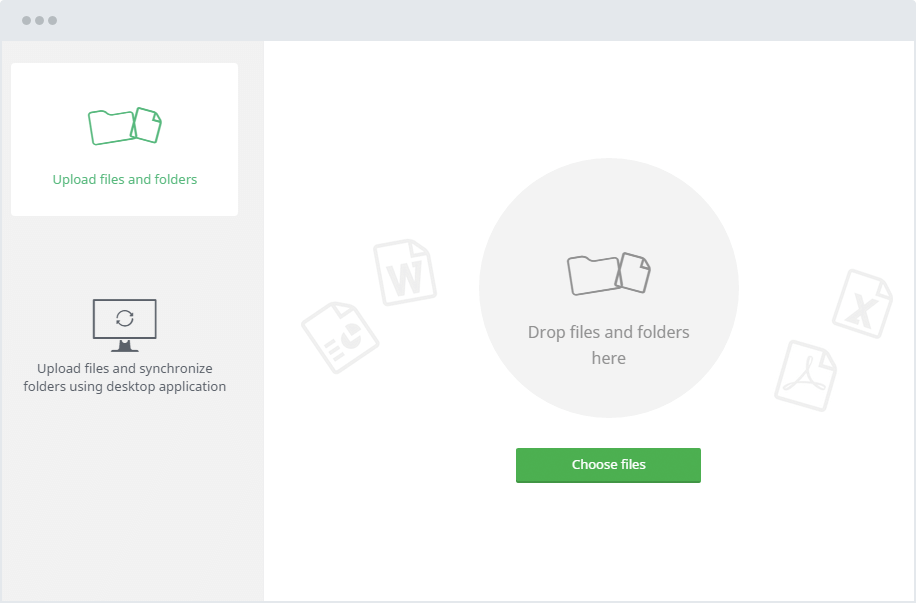

- Bulk uploads and downloads for voluminous paperwork

- Multi-channel notifications

What’s more, the most proven real estate management software provides a higher level and better user experience when dealing with commercial real estate due diligence. As a result, along with the tool, you will get access to valuable materials, checklists, and templates.

The commercial real estate due diligence process

Virtual data rooms with advanced functionality will always allow the users to break any project into stages, segments, and subsegments for everyone’s convenience. For example, typical commercial real estate due diligence constitutes three main processes:

Physical inspection. A thorough physical property assessment is the foundation of successful commercial real estate due diligence. Even a minor flaw can turn into a financial pitfall over time. That’s why it is crucial to involve all necessary experts to inspect the property, such as property management, property inspector, an architect, a broker, etc. .

VDR tip

Give the property inspector access to specific sections of the data room for real estate management. They might need to double-check previous inspection records, safety certification, building plans, etc.

Financial analysis. At this stage, a team of accountants and financial advisors will verify all the data presented by the seller. The general rule is not to take any information for granted and turn every stone looking for precise numbers.

VDR tip

Ensure the seller will not interfere with the financial analysis by creating a separate room or exclusive section for this stage.

Legal inspection. At this stage in the due diligence timeline, independent attorneys will assess various legal matters concerning the property. For example, they will investigate matters such as environmental impact, ownership rights and privileges existing, loan documents provided to you by a bank, and potential encroachments. As the final stage of commercial real estate due diligence period, legal inquiries will either make or break the entire process.

VDR tip

Synchronize the indexation of digital documents and their physical counterparts to ensure convenient and quick access.

Commercial real estate due diligence checklist

A checklist for commercial real estate acquisitions is an excellent tool for enhancing commercial real estate due diligence. Ask your real estate management software provider to put together a custom checklist or give you a ready-made template.

Also, you may use our helpful list of the crucial points to cover during commercial real estate acquisition and steer clear of costly mistakes.

- The most current title policy or title commitment on the property in the seller’s possession or control with all relevant documentation.

- ALTA land survey and topographic study, engineering plans, a copy of the construction blueprints, and as-built drawings in the seller’s possession or control.

- The property legal descriptions.

- Declaration of the property’s conditions, covenants, limitations, reservations, and easements

- Certificate of zoning compliance (including pending applications)

- List of all permits, certificates of ownership, partial certificates of ownership, government notices, warranties, code violations, unexpired warranties, and special assessments

- A copy of the property’s existing insurance policies and certifications, as well as any pending claims

- A schedule of pending litigation affecting the property and the seller’s ability to transfer the property

- Seller’s third-party engineering, boring reports, environmental reports, termite or radon studies, foundation reports, soil tests, appraisals

- Full copies of written lease agreements with certification confirming the absence of oral leases

- All rental property accounting and other income, commonly owned area maintenance, security deposits, real estate tax contributions paid by each tenant (including a certified rent roll, previous rent, past dues, security deposits, years of ownership, lease commencement date, lease termination date)

- All security deposits to which any seller, tenant, or other party is entitled

- Copies of tax bills for the last three years, including copies of tax protests, and copies of utility bills for the previous two years

- Complete copies of all written service contracts and a written summary of oral service contracts

- An accounting of all income and expenses for the last three years with collection reports and tax statements

- List of personal property owned by the seller and used in connection with the operation and maintenance of the property

- Any questions that the buyer may deem necessary to resolve concerning the status of the property’s title

Why do you need a data room for real estate management?

After conducting commercial real estate due diligence, you might want to continue using the data room for real estate management. In some cases, you will need to switch to a different plan or vdr structure, depending on the CRE’s purpose. But the majority of data involved in the due diligence process will come in handy later.

You can use real estate management software to supervise the property, plan upcoming development, facilitate potential mergers and acquisitions, and much more.

If CRE is only a portion of your investment portfolio, you can always upgrade to an Enterprise VDR plan and oversee all projects with ease.

References

- “The Authority on the Deals, Players and Trends Driving Commercial Real Estate Investments”. Real Capital Analytics, Inc. https://www.rcanalytics.com/

- Dec, 2020. “2021 commercial real estate outlook” by Jim Berry, Kathy Feucht. Deloitte. https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-real-estate-outlook.html

- Mar, 2021. “Due Diligence in Commercial Real Estate Transactions”. Wolters Kluwer N.V. https://www.wolterskluwer.com/en/expert-insights/due-diligence-in-commercial-real-estate-transactions

- Feb, 2021. “10 Commercial Real Estate Predictions For 2021” by Dan Dokovic, Forbes Councils Member. Forbes Real Estate Council. https://www.forbes.com/sites/forbesrealestatecouncil/2021/02/08/10-commercial-real-estate-predictions-for-2021/?sh=2e8dc27a32cc

- Jan, 2021. “Commercial Real Estate Trends & Outlook”. National Association of REALTORS. https://cdn.nar.realtor/sites/default/files/documents/2020-q4-commercial-real-estate-trends-and-outlook-survey-01-21-2021.pdf

- Dec, 2020. “Step by Step: Commercial Real Estate Due Diligence” by Tyler Cauble. The Cauble Group. https://www.tylercauble.com/blog/commercia-real-estate-due-diligence

- Hennessey, Brian (2015). “The Due Diligence Handbook For Commercial Real Estate”

Recommended for you