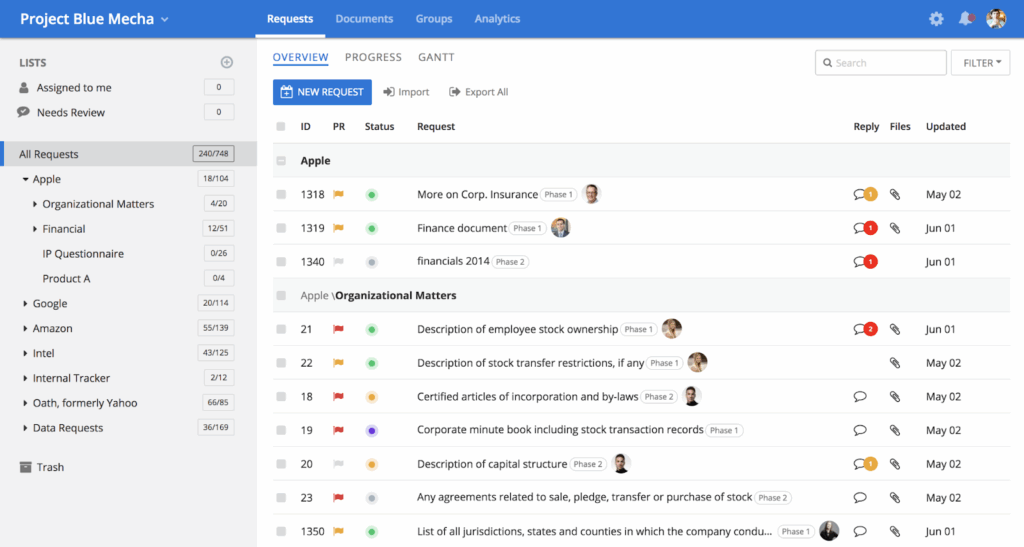

DealRoom is trusted by many M&A teams for its workflows and deal management tools, but no platform fits every need. Users say that some tasks can feel less smooth than expected.

In this guide, we’ll highlight where DealRoom can fall short and explore alternatives that could make your workflow easier and more efficient. This way, we will help you find the virtual data room that works for your team.

Why look for an alternative to DealRoom?

While many professionals find the platform useful, some data room reviews highlight areas where it can feel limiting.

For example, users note that DealRoom could improve its document management features to simplify keeping track of recent uploads. Others mention that the learning curve can be steep, especially for users new to the platform. Also, contact tracking and follow-up tools are not as robust as they would like.

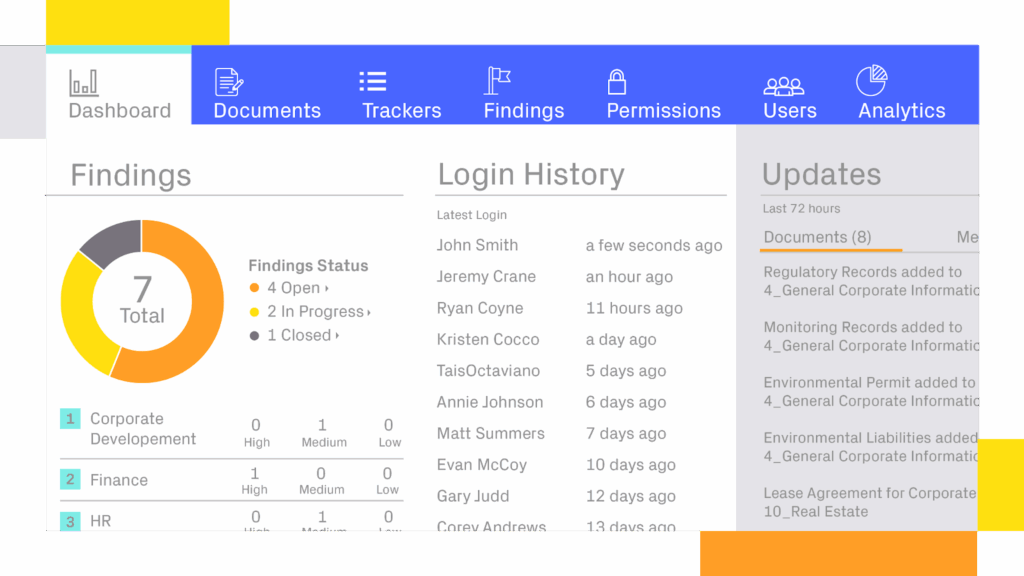

From a workflow perspective, a few users report minor glitches with data filtering and describe the reporting and export functions as less seamless than expected. Finally, while DealRoom does offer reporting features and email notifications, some teams would prefer more advanced analytics and customization.

Taken together, these reviews suggest that professionals may seek alternatives that provide the following:

- More intuitive navigation and user experience

- Advanced reporting and analytics

- Stronger CRM-style contact tracking

- Enhanced document management options

In high-stakes or industry-specific transactions, even small limitations can signal it’s time to look beyond DealRoom.

👉 Additional resources: Explore DealRoom pricing and what it includes.

What to look for in a DealRoom alternative?

The features buyers should prioritize in a virtual data room reflect the dealmaking environment. So, here are the key capabilities professionals increasingly need from their software, based on PwC’s latest Global M&A trends reports.

1. Operational readiness and deal agility

PwC notes that while private equity deal volumes and values are rising, many firms are simultaneously ‘looking inward, improving their efficiency and capabilities’ to be ready for rapid execution when opportunities arise. A strong alternative to DealRoom should therefore:

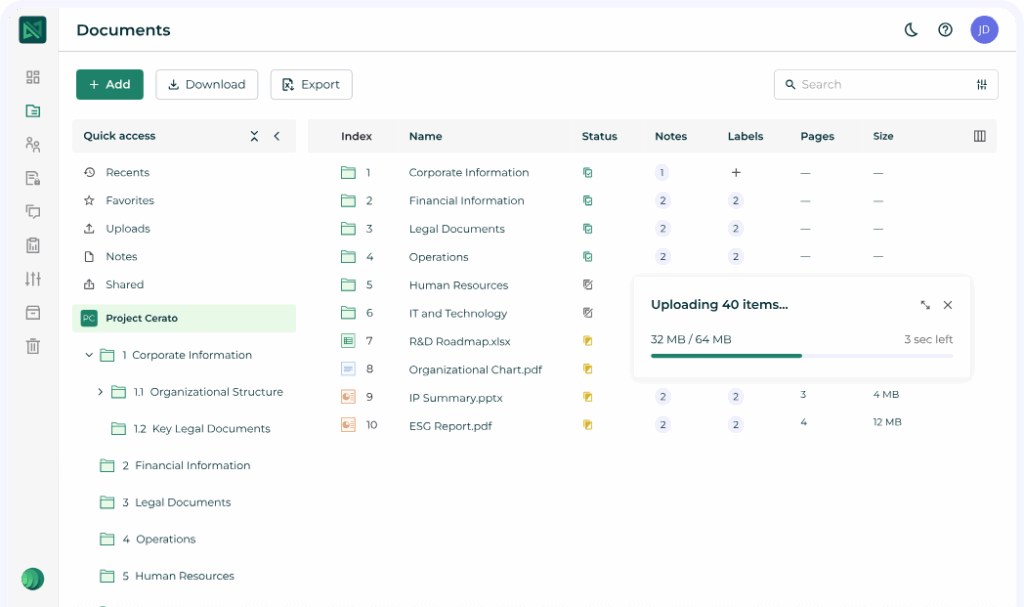

- Enable speedy onboarding of users and documents

- Offer intuitive navigation for fast-turnaround diligence

- Integrate with existing workflows for minimal friction

2. Advanced reporting and analytics

Dealmaking environments grow more complex. In particular, the health industry is facing tariffs, pricing reforms, and regulatory uncertainty. Consequently, buyers require deeper insights to model risk and value dynamically. So, evaluate VDRs for the following features:

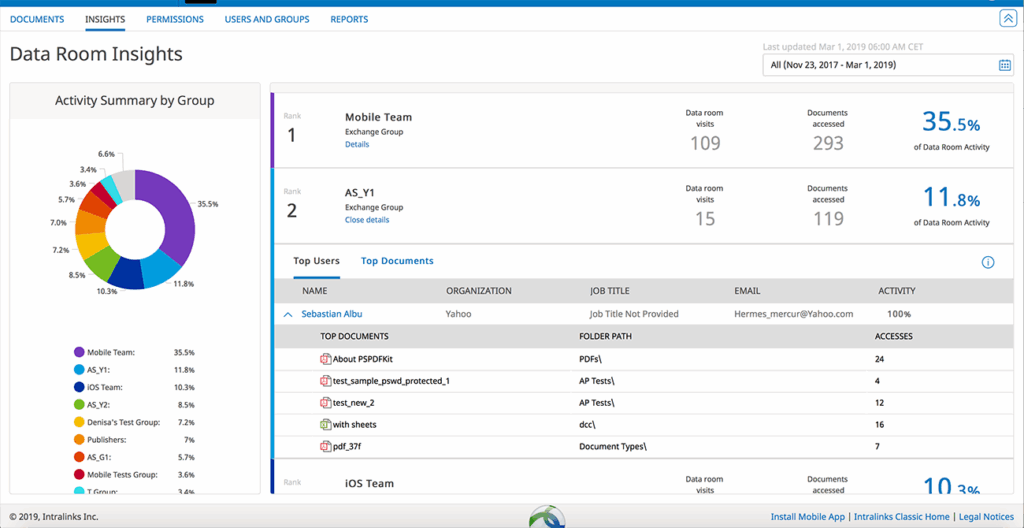

- Customizable dashboards and real-time analytics

- Exportable data to feed into financial and scenario modeling tools

- Advanced filtering and trend tracking capabilities for due diligence

3. Compliance, security, and resilience

Regulatory scrutiny and unpredictable macroeconomic shifts exert pressure on due diligence workflows. Thus, PwC emphasizes adapting diligence processes amid evolving policy environments. Consequently, you should choose the most secure deal room that offers the following security measures:

- Robust security protocols (MFA, encryption, access controls)

- Detailed audit trails and reporting for regulatory oversight

- Stability and scalability during peak usage

4. Sector-specific functionality and scalability

Different industries face unique deal drivers, whether it’s innovation pipelines in biopharma or secondary transactions in private equity. So, a VDR alternative should support such variability with the following:

- Custom templates or workflows for M&A

- Scalability to handle varied document loads and user roles

- Integration options with deal-specific tools (e.g., modeling, CRM).

5. Ease of use and collaboration

PwC’s findings around efficiency gains and internal process improvements underscore the importance of intuitive systems. In practice, that means buyers should look for VDRs with the following capabilities:

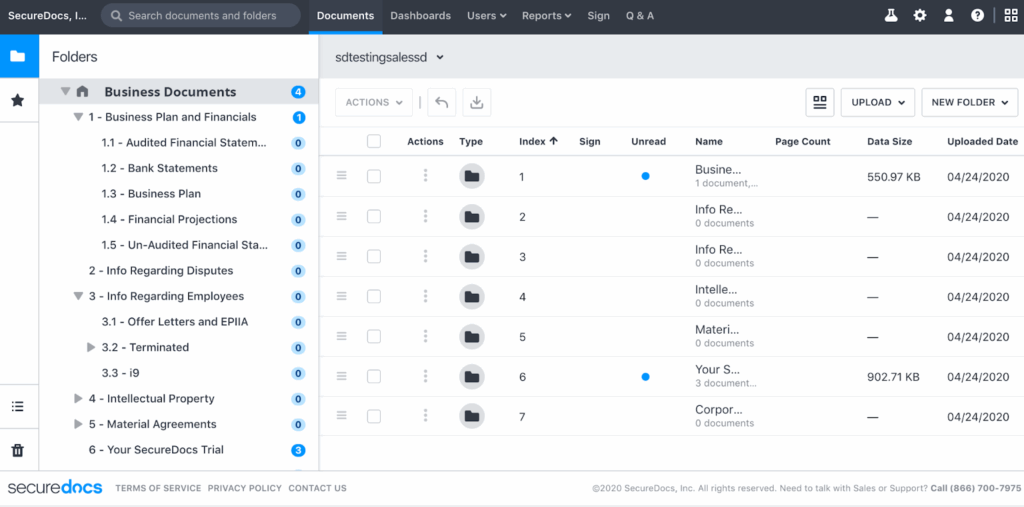

- Clear folder structures and navigation

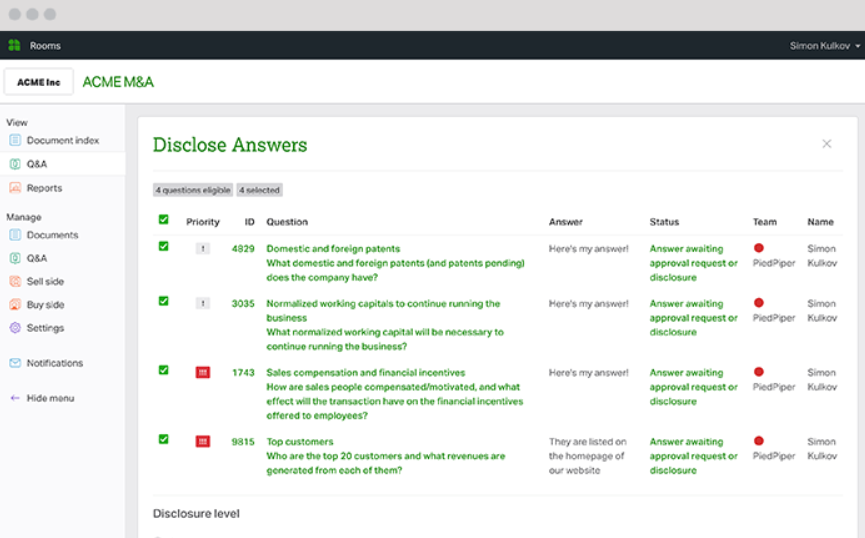

- Built-in communication and Q&A features for streamlined collaboration

- Mobile-friendly interfaces for remote or distributed deal teams

Learn more:

✔️Global M&A industry trends: 2025 mid-year outlook | PwC

✔️Global M&A trends in private equity and principal investors: 2025 mid-year outlook | PwC

✔️Global M&A trends in health industries: 2025 mid-year outlook | PwC

Best DealRoom alternatives in 2026

This table provides a side-by-side comparison of leading virtual data rooms, highlighting their key features, compliance, supported industries, trial options, and rating based on user reviews. Use it as a starting point to identify the DealRoom alternative that best fits your needs.

| Provider | Features | Compliance | Industries | Free trial |

| 1. Ideals | ✔️ Multi-layered data encryption ✔️ Granular permissions ✔️ Dynamic watermarks ✔️ Bulk document upload with high-speed processing ✔️ Full-text search and advanced filtering ✔️ User management across projects ✔️ Advanced Q&A module for real-time communication ✔️ iOS and Android mobile access ✔️ Custom branding ✔️ 24/7 in-app live chat support | ✔️ GDPRSOC ✔️ 2HIPAAISO ✔️ 27001 | ✔️ Financial services ✔️ Renewables and energy ✔️ Technology and telecom ✔️ Healthcare ✔️ Logistics ✔️ Legal ✔️ Private equity ✔️ Manufacturing ✔️ Transportation | 30 days |

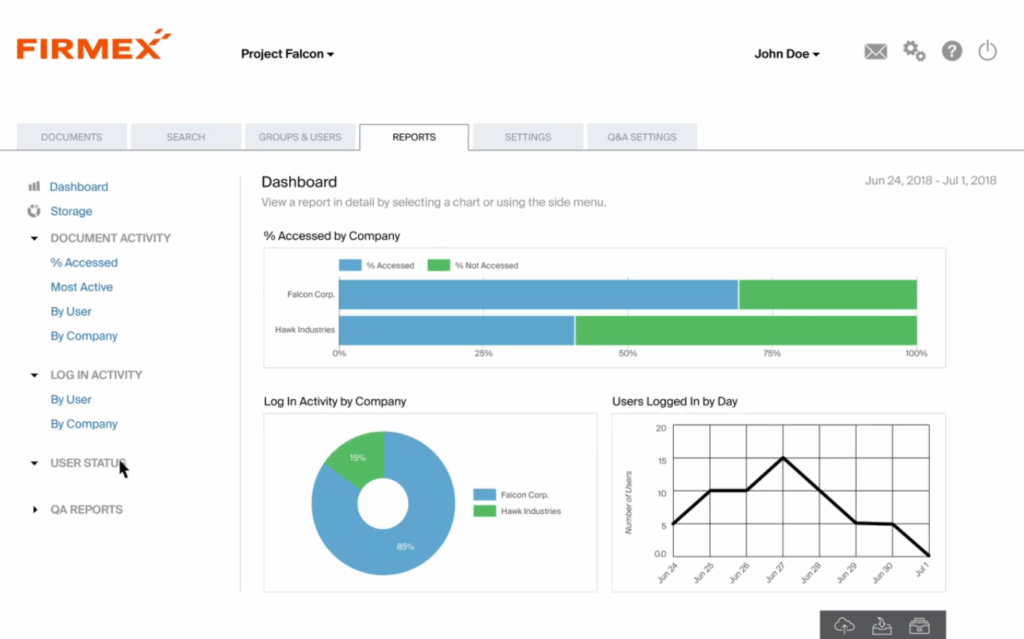

| 2. Firmex | ✔️ Granular access control ✔️ Easy data uploads ✔️ Detailed reports and analytics ✔️ Q&A module ✔️ View As tool ✔️ PII redaction ✔️ Instant setup | ✔️ GDPRSOC ✔️ 2HIPAA | ✔️ Investment banking ✔️ Corporate ✔️ Biotech and pharma ✔️ Government and infrastructure ✔️ Mining ✔️ Renewable energy ✔️ Legal ✔️ Private equity ✔️ Real estate ✔️ Oil and gas | 14 days(up to 10 users) |

| 3. Datasite | ✔️ Drag and drop uploads with bulk editing ✔️ Q&A with FAQ and Excel export ✔️ AI-powered redaction and PII detection ✔️ OCR search in 16 languages ✔️ Real-time engagement tracking ✔️ Custom dashboards | ✔️ SOC 2 Type II ✔️ ISO 27001, 27017, 27018, 27701 ✔️ EU and UK GDPR ✔️ CPRA ✔️ APP | ✔️ Oil and gas ✔️ Financial ✔️ Healthcare and life sciences ✔️ Industrials ✔️ Technology, media, and telecom ✔️ Consumer retail ✔️ Real estate ✔️ Renewable energy | ✖️ |

| 4. Intralinks | ✔️ Bulk drag-and-drop uploads with renaming tools ✔️ Q&A with bulk import and priority settings ✔️ AI-powered redaction ✔️ Automated index and real-time search ✔️ Customizable dashboards ✔️ One-click share and unshare | ✔️ ISO 27701 ✔️ GDPR | ✔️ Real estate ✔️ Energy ✔️ Life sciences ✔️ Legal ✔️ Financial ✔️ High-tech | ✖️ |

| 5. Ansarada | ✔️ Granular document security ✔️ Bulk AI-powered redaction ✔️ Granular document security ✔️ Real-time reporting and full audit trails ✔️ Deal Workflow project management tool ✔️ AI-powered deal insights | ✔️ ISO 27001 ✔️ GDPR | ✔️ Financial ✔️ Consumer retail ✔️ Real estate ✔️ Healthcare ✔️ Energy and industrials ✔️ Mining | 14 days |

| 6. SecureDocs | ✔️ Fast setup ✔️ Permission-based user roles ✔️ Audit trail reporting ✔️ Two-factor authentication ✔️ Customizable NDAs | ✔️ SOC 2 Type 2 ✔️ ISO 27001 | ✔️ Investment banking ✔️ Private equity ✔️ Legal services ✔️ Healthcare ✔️ Real estate | 14 days |

💡 Additional resources: Check virtual data room cost comparison to find the best option for your budget.

This table presents a preliminary view of each platform’s capabilities. So, explore each provider’s website to see which solution can meet your needs.

Pros and cons of DealRoom competitors

By weighing pros and cons, you can make a smarter, faster decision for your team and deals.

1. Ideals

✅ Pros

- Multi-project management under a single subscription

- Custom branding for a professional image

- Secure file-sharing tools and automatic data sync

- Easy setup for quick project launches

- Insightful activity reports

- Advanced Q&A with automatic question assignment

- Expert onboarding support

- Multilingual accessibility

❌ Cons

- Unclear pricing details

2. Firmex

✅ Pros

- Automatic notifications for new activity

- Customizable reports for tailored analytics

- Two-page view mode for PDFs

❌ Cons

- No Android app

- No desktop app synchronization

- Inability to view Excel documents with formulas

- Lack of search filters

3. Datasite

✅ Pros

- Ability to create FAQ sections and bulk-import Q&A from Excel templates

- Due diligence checklists and dedicated buy-side workflows

- Automatic document translation capabilities

- Flexible pricing options

❌ Cons

- No desktop synchronization

- Inability to view formulas in watermarked Excel files

- No annotation tools

- No centralized corporate account

💡 Additional resources: Explore our head-to-head analysis of Intralinks vs. Datasite to evaluate AI features, pricing, and UI

4. Intralinks

✅ Pros

- Effective reporting

- Fast document upload

- 24/7/365 customer support

- Flexible Q&A tools

- AI-assisted document redaction

- Reliable document security features

❌ Cons

- Occasional automatic index numbering issues

- Complicated permissions

- Performance bugs

- Tedious user experience

💡 Additional resources: Who are the top Intralinks competitors?

5. Ansarada

✅ Pros

- AI-powered redaction processing up to 500 files at once

- Due diligence checklists built from 50 million data points

- Predictive AI trained on 35,000 deals

- 100% human phone support worldwide

❌ Cons

- Excel files display as PDFs

- No labelling

- No annotation tools

- File upload limits

- Limited supported file types

6. SecureDocs

✅ Pros

- E-signature integration

- Ability to track read and unread files

- Reports with analytics

❌ Cons

- Difficult to manage document access settings

- Interface is only available in English

- No data room hibernation

When comparing virtual data rooms, consider the areas where DealRoom may fall short, such as document management, user onboarding, activity tracking, and reporting capabilities.

Choosing the right software for your needs: DealRoom vs alternatives

To narrow down the options, answer the following questions:

1. Do we usually juggle several projects at once, and would it help to keep them all in one place?

✅: Look for the best VDR tools with multi-project management under one subscription. This saves costs and keeps oversight simple.

❌: A more basic, single-project data room could be enough.

2. When a new deal comes in, do we need a platform that can be set up in hours rather than days?

✅: Choose a VDR known for fast setup and user-friendly onboarding. It’ll keep deals moving without IT bottlenecks.

❌: A more time-consuming setup might still work for you.

3. Is our Q&A volume high enough that automation would be an advantage, or can we manage with basic tools?

✅: Go for a provider with advanced Q&A workflows and automatic assignments to subject experts.

❌: A simpler Q&A tool is probably sufficient.

4. Will our team need to access and sync files across devices, or is logging in online good enough?

✅: Look for platforms with desktop syncing, offline access, and mobile options.

❌: A purely browser-based solution may be enough (and often cheaper).

5. Does our team work across regions and languages, making multi-language support essential?

✅: Opt for a platform with a multi-language interface and support staff to ensure smooth communication.

❌: Language support may not be a critical factor.

6. Would custom branding make a difference in how professional we look to counterparties?

✅: Select a VDR that allows full logo, color, and domain customization.

❌: Branding isn’t worth paying extra for.

7. Given our industry, what’s the minimum level of security and compliance we should insist on?

- If you’re in finance, healthcare, or other regulated industries: Make sure the VDR meets the strictest compliance standards (SOC 2, HIPAA, GDPR).

- If compliance is lighter in your industry: Security still matters, but you may not need the most advanced certifications.

Final thoughts

The best solution will feel less like a tool you have to adapt to and more like a system that adapts to you.

Whether your priority is streamlining due diligence, managing multiple projects, or ensuring global accessibility, the right choice can save time, reduce risk, and create smoother collaboration across every stage of the deal.

Take the time to reflect on your needs, weigh the trade-offs, and remember: the VDR you choose today will shape how efficiently and securely your deals run tomorrow.

FAQs

1. What are some alternatives to DealRoom for M&A?

There’s no single “best” option because everything depends on your priorities. If you need advanced Q&A workflows, bulk document redaction, and strong analytics, look for platforms with robust deal-specific features. For smaller M&A teams, a tool with a simpler setup may be sufficient.

2. Are there more affordable options than DealRoom?

Yes. Some virtual data rooms offer more flexible pricing, such as pay-per-page or pay-per-project models. They can be more cost-effective for smaller deals or short-term use. The trade-off is usually fewer advanced features. Therefore, it’s important to balance price with functionality.

3. Which platform similar to DealRoom is most suitable for life sciences?

Life sciences companies often handle sensitive clinical data, trial documentation, and global regulatory requirements. So, a good alternative would be a platform that supports strong document security, automatic translation, multi-language support for international collaboration, and efficient permission management.

Recommended for you